Good Weather, Strong Re-Stocker Demand To Underpin Cattle Sales Prices

Cattle Sales Prices Forecast To Remain Strong

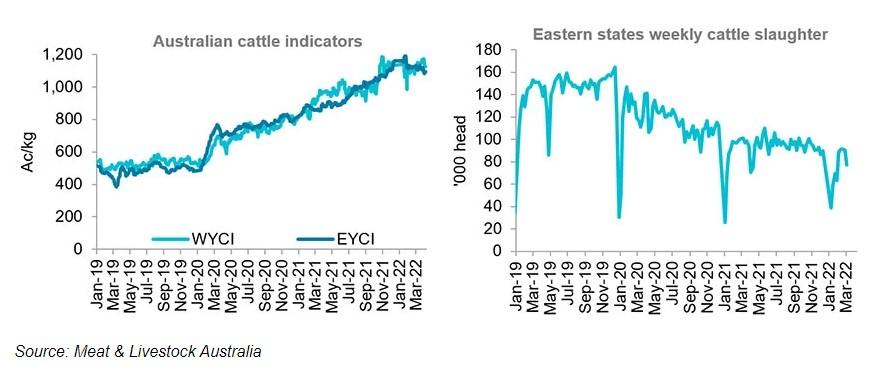

The Eastern Young Cattle Indicator (EYCI) has experienced a modest decline of 3.2 per cent to 1,095c/kg after reaching a high of 1,131c/kg in mid-March, largely driven by an increase in cattle slaughter during the last month, according to Rural Bank’s April ‘Insights’ report. Despite continuing to ease, the EYCI is still 25 per cent higher compared to this time last year, it adds.

The Western Young Cattle Indicator (WYCI), meanwhile, has increased two per cent over the last month to 1,127c/kg, 17 per cent higher year-on-year, it notes. The national heavy steer indicator fell two per cent through the past month, ending at 791c/kg.

Rural Bank reports weekly slaughter declined at the start of March, before rising to end higher. Slaughter increased throughout the month to be 34 per cent higher year-on-year. This is also 22 per cent higher month-on-month, it says.

South Australia was the only state to experience a decline in slaughter rates during March, according to Rural Bank, while Queensland slaughter rose from 33,171 head in the first week of March to 49,571 head for the first week of April on the back of plants reopening following the severe impacts of the flooding and heavy rainfall in March. It is expected that slaughter rates will continue to rise throughout the next month.

Rural Bank points out that Australian beef exports trended upwards by 25 per cent month-on-month in March, however, were still lower year-on-year by 11 per cent. Exports to South Korea, Japan and the US all rose by just under 25 per cent throughout the last month while China recorded a 17 per cent rise.

“With China’s rise throughout the past month, it has overtaken South Korea to be Australia’s second-largest beef export market for 2022 so far,” it says, noting that from April 1 Australia’s tariff rate in Japan has marginally declined as per the Japan-Australia Economic Partnership Agreement, reaching 27 per cent this year and a floor of 23.5 per cent in 2028.

Rural Bank suggests Australia’s cattle prices are expected to continue easing with an increase in supply throughout the coming months.

“Yet, with a favourable weather outlook and ongoing firm re-stocker demand, prices will continue to be supported at well-above-average levels,” it says.

Find more information on livestock propeties for sale on Farmbuy.com