MLA Forecasts Strong Growth In Cattle Market

Slaughter And Production Forecast To Hit Record Highs

With above-average rainfall predicted across New South Wales and parts of Queensland, the national cattle herd rebuild is set to continue through to 2024 when slaughter and production levels will hit record highs, according to Meat & Livestock Australia’s (MLA) first Cattle Industry Projections update for 2022.

Click on any of the following links to go straight to MLA's detailed analysis of the industry's key performance indicators, including:

National Herd

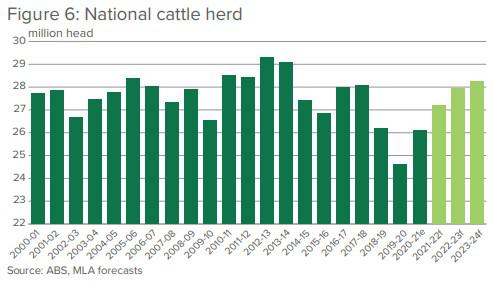

In a recent online presentation of the update, MLA said the national herd is projected to grow by 1.1 million - or 4 per cent - to 27.2 million head in 2022 as the rebuild becomes more pronounced.

However, MLA’s Market Information Manager, Stephen Bignell, cautioned that the pace of the rebuild will vary across different states, underpinned by a third year of favourable seasonal conditions for southern Australia.

“Herds in the southern states of New South Wales and Victoria will mature favourably, with large numbers of high-quality young breeding females and heifers joined to deliver a large cohort of calves for the 2022 spring. Females will be well nourished from abundant and good-quality pastures promoting favourable growing conditions,” he said.

“While the southern states are accelerating their rebuilds, success in the north will be ongoing, albeit at a slower pace.

“While Queensland’s rebuild has been aided by excellent spring and summer rainfall events in central and southern parts of the state, the northern pastoral system requires a positive end to the 2022 wet season before it’s rebuild can definitively begin in 2023.”

With another good wet season in 2023, the MLA expects the national herd to hit 28.25 million head in 2024, 8 per cent up on 2021 to the highest level since 2014.

“I’d like to see another good wet season for the rebuild in the north to really strengthen to develop and mature like we’ve seen in other states,” added MLA Market Information Analyst, Ripley Atkinson.

Bignell pointed out the rebuild is forecast to slow - with growth of 4.2 per cent in 2022, 2.7 per cent in 2024, and 1.2 per cent in 2024 expected.

“It shows the herd will mature; but it also shows we may get a turn of weather events in 2023 or 2024,” he said.

“Assuming there’s a continuation of favourable seasonal conditions for the eastern seaboard, forecast rainfall will provide solid bodies of feed entering winter.”

Though Bignell adds: “We’re in the second Le Nina, and BOM expects 80 per cent of Queensland to get above-average rainfall in the next three months. Statistically, you don’t often get three Le Nina’s in a row [though] it did happen in the ‘70s and in the ‘90s.

“Should 2022 not turn out as favourably as we expect, the season won’t be as bad as we saw in 2018-2019 because of the good seasons we’ve had.

“The good outlook for the next three months means there’ll be good water in the dams, good soil moisture, grass in the ground and grain.”

Slaughter & Production

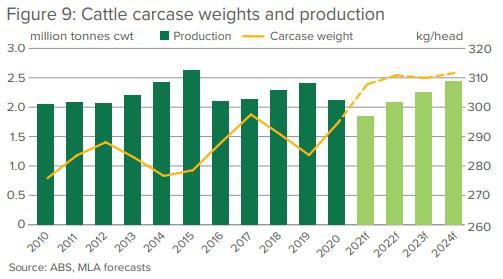

Off the back of strong herd growth, the MLA forecasts slaughter numbers to rise by 11 per cent (or 700,000) to 6.7 million head in 2022. By 2024 the slaughter rate is predicted to hit 7.85 million head, up 31 per cent on 2021, albeit off a low base and below the 10-year average.

As a result, production volumes are expected to reach 2.08 million tonnes, assisted by record carcase weights of 311kg/head – up 2kg year-on-year and up 128kg since 2019.

Bignell pointed to several factors driving higher carcase weights, including “… improvements in management style, improvements in genetics, and the increasing prevalence of the lot-feed sector”.

“Higher prices are incentivising producers and lot feeders to add kilos – it makes economic sense,” he said, adding he expects carcase weights to remain around the 311kg-mark in 2023 and 2024 before plateauing as prices soften.

Not surprisingly, then, some 2.85 million head entered the feed-lot system in 2021 – with the sector accounting for 50 per cent of beef production.

Bignell expects this to strengthen further, with throughout running at one million head a quarter in 2022.

“That compares to a capacity of 1.4 million head (a utilisation of around 77 per cent) and there are more projects to come online to further boost the feedlot sector’s capacity,” he added.

By 2014, production is predicted to hit a record 2.448 million tonnes, according to the MLA – higher than the drought-inducted turn-off year of 2019, Ripley pointed out.

Export Markets

Bignell said the record numbers are a positive sign for export markets, with volumes forecast to exceed one million tonnes (1.08m tonnes) in 2022, jumping to 1.224m tonnes in 2024.

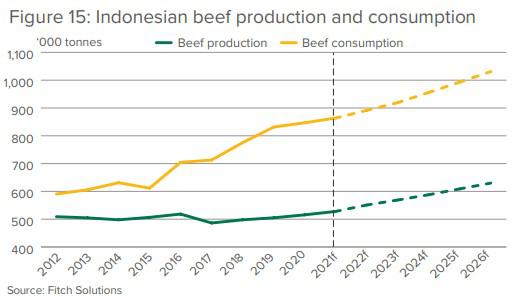

Live export is expected to top 750,000 head this year, and 830,000 by 2023, driven by increased supply off the back of the national herd rebuild and a resilient Indonesian market.

Growth in South Korea (now Australia’s second-largest market behind Japan), Indonesia, the Philippines and Vietnam is also helping to offset the decline in sales to China, he added.

“Following a challenging 2021 for export markets, Australian beef will enter a significant high-value export market when the Australia-UK Free Trade Agreement comes into effect later this year,” Bignell said.

“As many countries continue to recover from the pandemic, demand for Australian beef is expected to grow in line with improving supply of cattle from the second half of 2022.”

However, Bignell cautioned that the industry faced headwinds in 2022 with transportation, staff shortages and the potential for the Australian dollar to appreciate all challenges to manage.

“While these challenges remain, the beef industry is experiencing market conditions and confidence never seen before at a producer level,” he said.

“Overall, the industry is in an incredibly positive position and will continue to deliver high value, high-quality Australian red meat to both emerging and established global markets.”

Domestic Consumption

MLA said continuing cattle pricing pressures impacting retail prices have seen consumption fall – though an 11 per cent quarter-on-quarter increase in beef retail prices in the third quarter of 2021 drove overall sales value growth.

It noted that COVID-19 variants have dramatically disrupted the recovery of the food service channel, with grocery stores the key beneficiary.

The butcher sales channel has not fared as well, MLA noted, with beef sales value and volume down by 6.2 per cent and 14.1 per cent quarter-on-quarter, according to Nielsen Homescan.

E-commerce has also bridged the gap of declining foot traffic in the retail market, but challenges such as labour shortages and last-minute delivery have greatly limited their margin growth.

MLA pointed to ABS data indicating that Australians are spending about $13 billion a month on food purchases. The data also indicates that Australians are still spending less on food service than they were in March 2019. With each lockdown, it appears the return to food service spending when the lockdown ends is getting less and less, MLA suggested.

“Therefore, the increase in retail spending for food seems to be a structural trend that will continue post COVID-1,” it noted.

“Each month, Australians are also spending nearly $1 billion on online food – another structural change in domestic spending habits that are expected to continue post-pandemic.”

Overall, MLA believes future population increases, along with income and macroeconomic growth, will continue to support firm demand for beef in the long term.

“However, current market dynamics – with increases in beef prices or reduced consumer incomes as a result of the pandemic – are seeing some shifts in the beef products consumers buy and the sales channels they use.

“Beef mince, beef sausage, rump steak, pre-prepared and sirloin (porterhouse) steak are the top-five fastest-growing cuts for online retailers, while beef stirfry/diced/strip/casserole cuts, mince and rump steak are the most popular cuts in brick-and-mortar stores,” MLA added.

Prices

All up, by June 2022 prices are predicted at between 921 cents per kilogram carcase weight (CWT) and 1,059c/kg CWT – with a mid-point of 997c/kg CWT, according to the Eastern Young Cattle Indicator (EYCI), an aggregate average of forecasts from six respected industry analysts compiled by MLA.

The medium point would reflect a 11 per cent decline in current prices, Bignell noted, but compares with the 10-year average EYCI of 547c/kg CWT.

“At 997 that is still 82 per cent higher than the 10-year average and only 2021 prices are higher. So for producers out there, there is still strength in the market,” he said.

“The reason for any dip is as the rebuild matures, they’ll be greater supply of animals and there might be a little less re-stocker demand. But encouragingly, these are still record prices in an historical context.”

Click on the highlighted link to view more than 140 livestock properties for sale Australia on farmbuy.com.