Strong Prices, Increased Production Forecast To Boost Beef Value To Record Level

Production Value Headed For Record On Back Of Higher Production, Lower Prices: ABARES

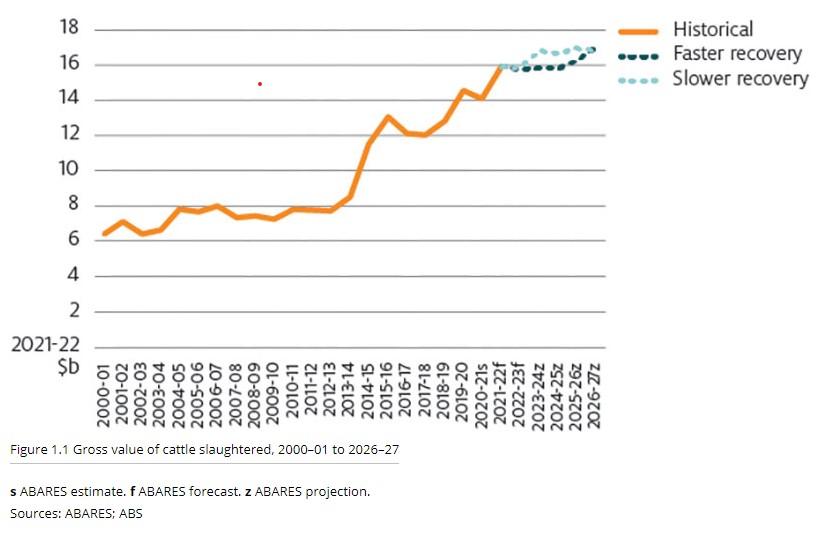

The gross value of production for beef and veal is forecast to increase 8 per cent to a record $15.7 billion in 2021-22 due to record cattle prices, according to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) just-released Agricultural Commodities Report.

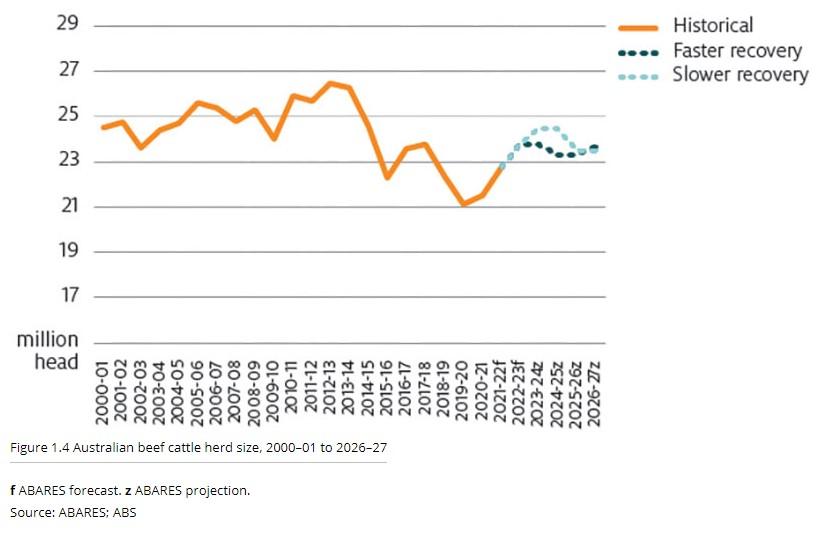

Report author Jonathan Wong notes that high rainfall across much of eastern Australia has led to greater pasture availability and widespread restocking. Graziers, eager to capitalise on pasture availability and facing a low national cattle herd, have broken cattle price records buying scarce cattle, he says, adding that high world beef prices have given graziers confidence they can pay high prices now and profit from future sales.

“The difference between the domestic cattle and world beef prices can be referred to as a confidence premium. Such a strong confidence premium has made Australian cattle amongst the most expensive in the world,” Wong writes.

Rebuilding momentum is likely to slow into 2022-23, he cautions, resulting in higher production, falling prices, and gross value increasing to $16.3 billion.

“Rainfall returning to average levels will weigh on restocking momentum and remove most or all the current confidence premium from prices,” Wong reports.

“Domestic price falls will be limited by world beef prices, which are expected to remain relatively high through the outlook period.

“Higher food price inflation would result in higher world beef prices in a scenario of a slower global recovery from COVID-19 disruptions. If this were to occur, the gross value of beef and veal production could be higher in 2022–23.”

In 2026-27, ABARES predicts gross value will reach $19.9 billion due to strong world prices and increased beef production.

World beef prices and Australian beef production could be slightly lower in a slower-recovery scenario, resulting in a gross value of $19.2 billion, Wong notes.

“The most significant risk to these projections is climate variability, which can prompt graziers to increase or decrease their herd size, impacting future prices and production,” he adds.

Cattle Prices

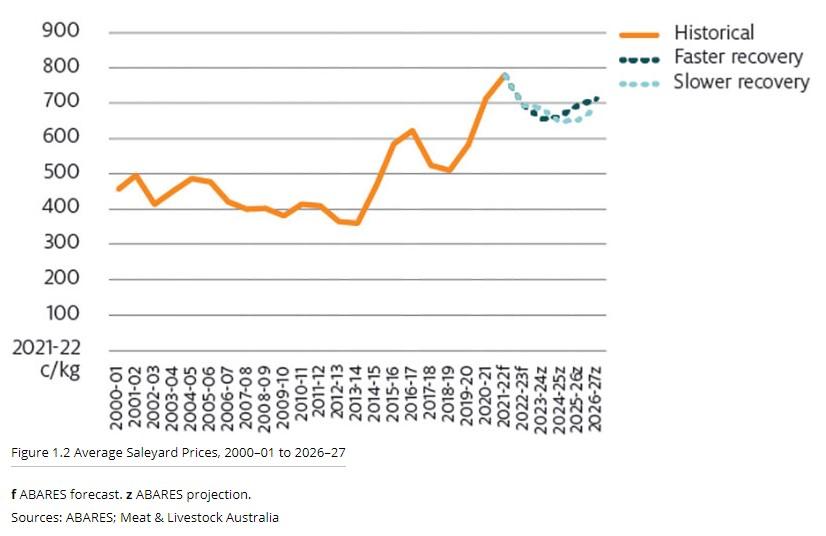

Australian cattle prices are forecast to fall to 711c/kg in 2022-23, with average rainfall slowing pasture growth, herd rebuilding and demand for younger cattle, compared to that seen in 2021-22, ABARES suggests.

“This will erode the ‘confidence premium’ keeping Australian prices high relative to competitors. Domestic price falls will be limited by world prices for beef, which are expected to remain relatively high through 2022-23,” reports Wong, noting that slightly-higher-than-expected world meat price inflation would result in higher average saleyard prices for Australian cattle, with prices only falling to 725c/kg in the slower-recovery scenario.

Under the faster-recovery scenario domestic prices will fall again in 2023-24, as graziers consider reducing herd sizes due to the dry conditions, ABARES forecasts. Prices will follow a similar but delayed pathway under the slower-growth scenario, which has the driest year in 2024-25.

“Prices are expected to recover towards the end of both scenarios as the world returns to more stable economic conditions and demand for beef increases. Prices will also be supported by more favourable climatic conditions which will allow graziers to maintain their herd sizes,” Wong writes.

Production

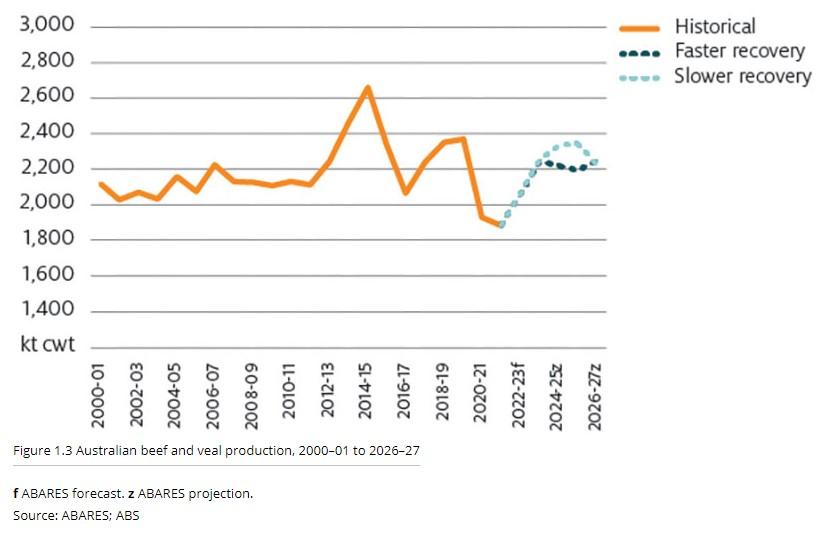

Australia’s beef and veal production is forecast to fall by 3 per cent to almost 1.9 million tonnes in 2021-22, according to ABARES, with COVID-19 related disruptions, ongoing labour shortages, high domestic cattle prices and lower cattle availability putting a ceiling on output.

Slaughter volumes have been low over the past 12 months, it notes, suggesting that cattle that could have been slaughtered are remaining on farm for longer and increasing their weights.

“It should be noted that despite the drought-breaking rains in parts of Australia and subsequent cattle price spike in early 2020, female slaughter only dropped below 47 per cent – which traditionally signifies a herd rebuild – nationally in the March quarter of 2021,” Wong writes.

ABARES forecasts production will increase to 2.1 million tonnes in 2022-23 due to greater cattle availability, cheaper cattle and additional processing labour.

Herd growth, though, will slow with less favourable climatic conditions, it adds.

“In the faster-recovery scenario, turn-off will accelerate in 2023-24 with low national rainfall causing farmers to destock. This will result in higher numbers of lighter cattle being sent for slaughter,” Wong reports.

Slightly more favourable climatic conditions will see marginally higher production in the slower-growth scenario, as processors have access to heavier cattle, despite lower turn-off.

“Graziers will be able rebuild herds for longer, with a larger base herd in the following years. The scenarios differ most in 2025–26, with dry periods at different points resulting in different numbers of cattle available,” Wong writes.

Exports

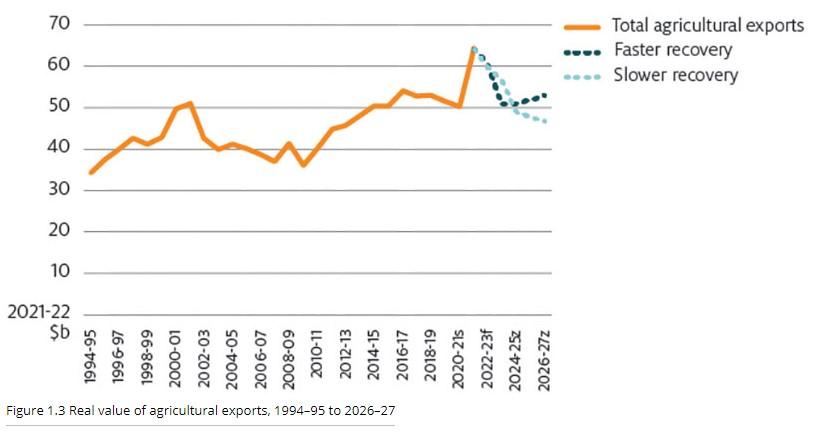

Exports are forecast to increase 11 per cent to $9.1 billion in 2021-22, according to ABARES, and remain at that level in 2022-23 as production increases balance price falls.

“Through the outlook period, increasing beef production will result in greater export volumes, with falling domestic cattle prices expected to make Australian beef more competitive against other beef exporters,” Wong reports.

“World prices are also expected to remain relatively strong through the outlook period.

“In 2026-27, exports will range from $10.2 billion under the faster-recovery scenario, to $10.3 billion under the slower-growth scenario, with the difference largely being driven by global meat prices.

In terms of volume, exports are forecast to increase 6 per cent to over one million tonnes in 2022-23, enabled by greater domestic production, which is expected to occur even in a slower-recovery scenario.

Similarly, exports are predicted to reach around 1.2 million tonnes in 2026-27 under both scenarios, fuelled by increased production, improved price competitiveness as a result of falling cattle prices, a lower exchange rate and the a reduction of tariffs under a range of free trade agreements.

ABARES forecasts live exports will fall 16 per cent to 649,000 head in 2021-22, due to strong domestic prices and limited availability making cattle too expensive for some live cattle importers.

“Additionally, pandemic-related economic slowdowns in key South-East Asian markets reduced incomes and meant less consumers were buying beef from Australian live cattle,” Wong notes.

Looking further ahead, ABARES suggests live exports will increase through the outlook period as more cattle become available, cattle become more affordable and consumer incomes increase.

World Supply & Demand

US beef production is forecast to fall slightly from 2021 to 2023 as the contraction phase of its cattle cycle continues, ABARES says.

Frozen beef supplies are expected to slightly increase through the outlook period, it adds.

ABARES notes that Brazilian beef exports are expected to recover following the recommencement of exports to China.

World demand, meanwhile, is expected to rise over the outlook period, with forecasts for positive but slowing economic growth across major export markets, including developing countries.

Wong notes that as the US herd contracts, more cows have been slaughtered, creating greater domestic supplies of processing grade beef.

“This will slightly reduce demand for imported processing beef and is likely to continue through 2022 and into 2023,” he writes.

ABARES expects strong demand from North Asian markets through the outlook period.