Pork Production Forecast To Hit New Record In 2022

National Herd, Slaughter Volumes And Production On The Rise

Australian pork production is forecast to reach a new record of 450,000 tonnes (MT) carcass weight equivalent (CWE) in 2022, up slightly from the 2021 record outcome of 444,000 tonnes, according to a report released by the United States Department of Agriculture’s (USDA) Foreign Agricultural Service on March 3, 2022.

This forecast is supported by data from Pork Australia, which recently noted that its latest estimate – based on feedback from two-thirds of its producer members – is for Australian pork supply to grow by 5.5 per cent in the July-to-December 2021 period, versus the same time last year.

“Domestic pork prices firmed in the second half of 2021 and following a second successive record winter crop production year, feed prices have remained far below the levels reached during the drought,” the USDA notes in its recent report.

“With no major shift anticipated in what are strong pork prices, and with ample supply of feed grain at good prices, conditions are set for a modest 1 per cent growth in pork production.”

While the impacts of African Swine Fever (ASF) on the global market are reported to be easing, particularly as the pig herd rebuild in China continues, it notes a full recovery of the pig industry in China is expected to take some time.

“And for this reason, world pork prices are likely to remain firm in 2022. Even though Australia is not a significant exporter of pork, these world pork prices have an influence over domestic prices and in turn sentiment towards production,” the USDA suggests.

Domestic Herd

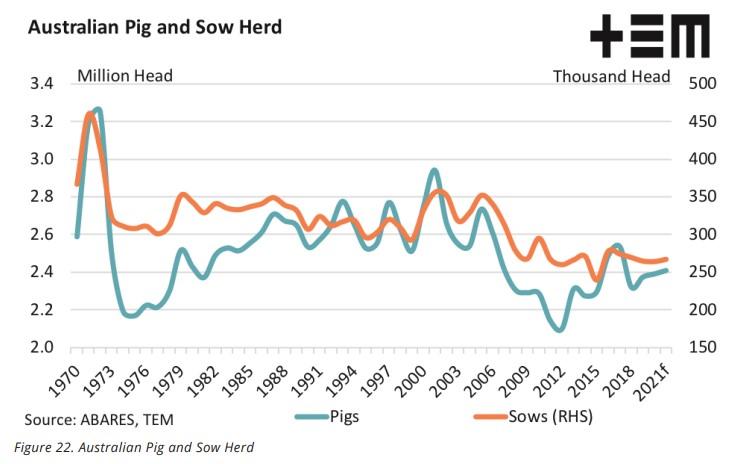

After a growth phase from the mid-1970s to the early 2000s, during which the Australian pig herd grew from 2.2 million to 2.9 million head, industry rationalisation and a period of high feed costs saw the herd shrink to record lows by 2012 of just under 2.1 million head, according to the State of the Industry Report 2021 produced for Pork Australia by Thomas Elder Markets (TEM). In recent years, TEM notes, the herd has stabilised at around 2.4 million head.

Similarly, Australia’s sow herd has declined from 300,00-350,000 head through this period to record low levels of around 250,000 head, before stabilising in recent years at approximately 265,000 head, TEM says.

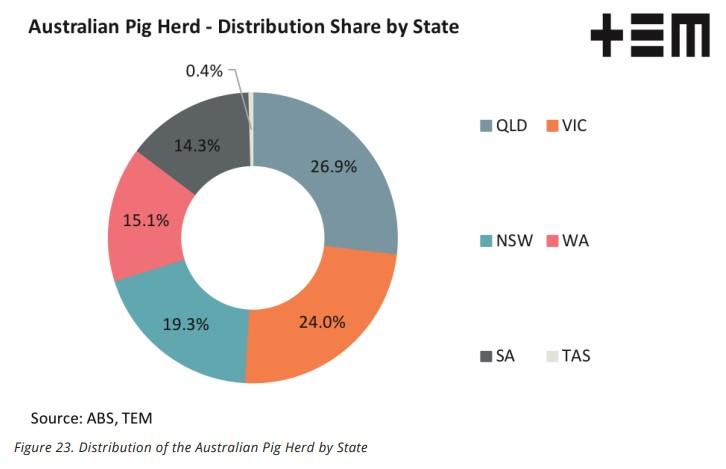

Australian Bureau of Statistics (ABS) data shows a relatively even distribution of pigs across the mainland, with Queensland holding the nation’s largest pig herd at just over 607,000 head or nearly 27 per cent of the total Australian herd, ahead of Victoria with nearly 543,000 head (24 per cent), New South Wales at 435,000 head (19 per cent), Western Australia at 340,000 head (15 per cent) and South Australia at 323,000 head (14 per cent).

Slaughter

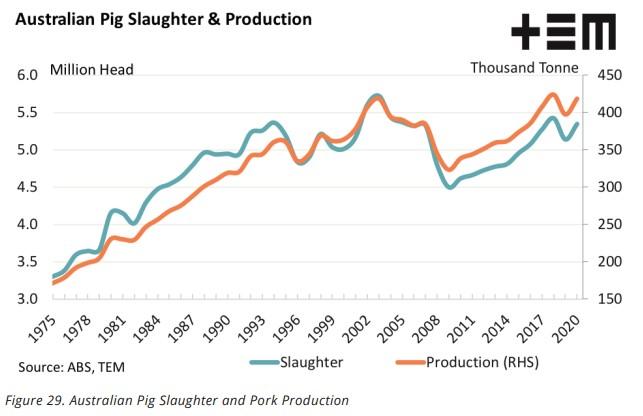

TEM says the decline in the pig herd during the first decade of the 2000s had a noticeable impact upon slaughter levels, which peaked in 2003 at 5.7 million head, before easing by 21 per cent to the 2009 lull of 4.5 million head.

Since 2009 annual slaughter levels have lifted by nearly 19 per cent to reach 5.3 million head in 2020.

Domestic Consumption

Pork consumption is forecast to remain stable in 2022 at near peak levels, primarily due to the expectation of relatively stable production and trade, the USDA notes.

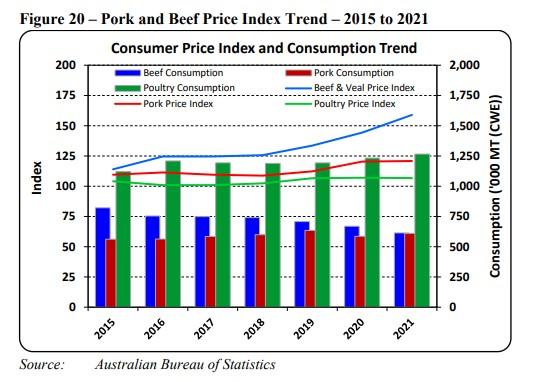

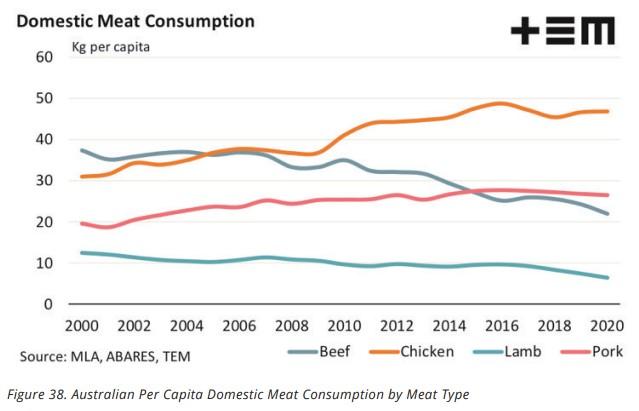

It reports that the consumer pork price index has increased only modestly over recent years, and poultry prices have had even less of an increase, whereas beef has seen a large and rapid rise.

“Interestingly, since 2015 beef consumption has declined by a little over 200,000 MT (CWE) while pork consumption has increased by merely 50,000 MT (CWE), and poultry has had the biggest rise at a little under 150,000 MT (CWE). The large rise in beef prices has resulted in consumers mainly substituting beef for chicken rather than pork,” the USDA notes.

Australian consumption of pork in 2021 has been revised up to 616,000 MT (CWE) from the official USDA estimate of 605,000 MT (CWE), representing around a 5 per cent increase to that of 2020.

“This is part of a steady increasing trend over the last 20 years with consumption growth of almost 50 percent,” the USDA reports.

Pork Australia, meanwhile, believes domestic pork consumption will increase by 4 per cent in the 2021-22 year.

“Re-stocking in both beef and lamb industries, combined with high international demand, is driving high lamb and beef farm gate prices.

“The growth in Australian pork consumption domestically is in part driven by increased beef and lamb prices to consumers,” it notes, adding current retail price differentials for pork from beef, lamb and chicken will continue for the 2021-22 year.

TEM points out, however, that despite the decline in market share of beef consumption on a per capita basis it remains the largest meat spend at the retail level on a value basis with 35 per cent of the retail domestic spend.

“Chicken, the high-volume and low-value transaction, holds the second spot in terms of proportion of the retail meat spend with a 30 per cent share,” it adds.

“Lamb and pork share the third position with 11 per cent of the retail spend, with lamb tending towards the higher-cost, lower-volume transaction in recent years. Whereas the pork transaction has demonstrated a higher per capita volume than lamb, but at a lower retail price, per unit.”

Prices

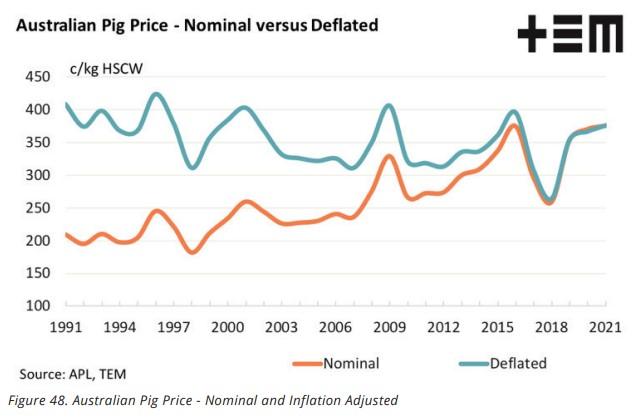

On a nominal basis, TEM says annual average Australian pig prices have experienced an upward trend over the past three decades from 200c/kg HSCW (hot standard carcase weight) to over 350c/kg in recent years.

“However, on an inflation-adjusted basis, the price trend has moved broadly sideways, albeit with a slight downward bias, ranging between 300c/kg to 400c/kg, in current dollar values for much of the period,” it adds.

At the retail levels TEM notes pork pricing has demonstrated more moderate growth during the 2009 to 2021 period compared to beef and lamb, increasing by 23 per cent to average 1256c/kg in 2021.

In contrast, retail beef prices increased 65 per cent in the period, while lamb prices rose 63 per cent.

The retail price of chicken, meanwhile, has been relatively static, falling just 2 per cent over the past decade.

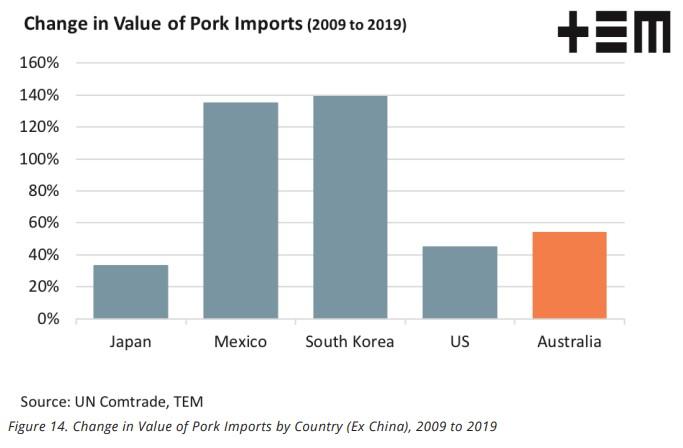

Imports

Australia’s pork imports are expected to remain steady at 210,000 tonnes (CWE) in 2022, in line with the official USDA estimate. If realised, this would be the lowest result since 2016.

TEM notes, though, that imports have jumped from around 8 per cent of domestic consumption in 1999, to an average of around 46 per cent over the past decade.

“This relatively low level of imports is a consequence of the increasing domestic production and high import prices for pork,” the USDA says.

“Pork import prices have steadily risen over the last three years with the average annual price increasing by 23 per cent since 2019.

“However, import prices declined over the tail end of 2021 and fell below the corresponding period in 2020.”

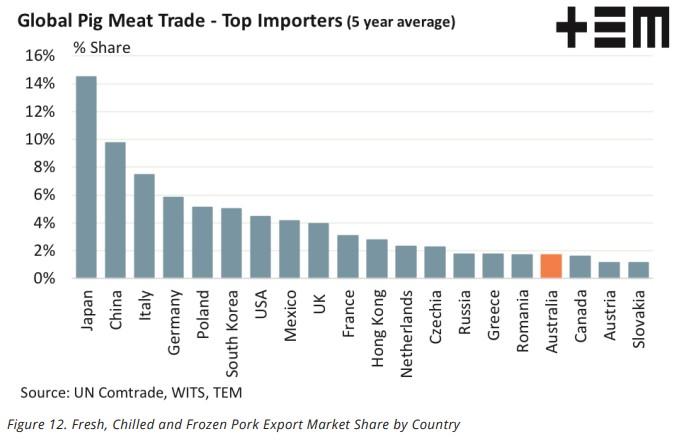

The USDA points out that in recent years the top-four suppliers of pork to Australia have accounted for more than 90 per cent of total imports.

The US, it adds, is the largest supplier, however its share decreased to 38 per cent in 2021 from over 50 per cent in the previous two years.

“In 2021 the three other major suppliers - Netherlands, Denmark and Ireland - all substantially increased supply to Australia.

“Pork imports in 2021 were 210,000 MT (CWE), 5,000 MT (CWE) higher than the official USDA estimate of 205,000 MT (CWE).

“This higher import result is despite production exceeding earlier expectations and was influenced by higher domestic consumption demand than previously anticipated,” it reports.

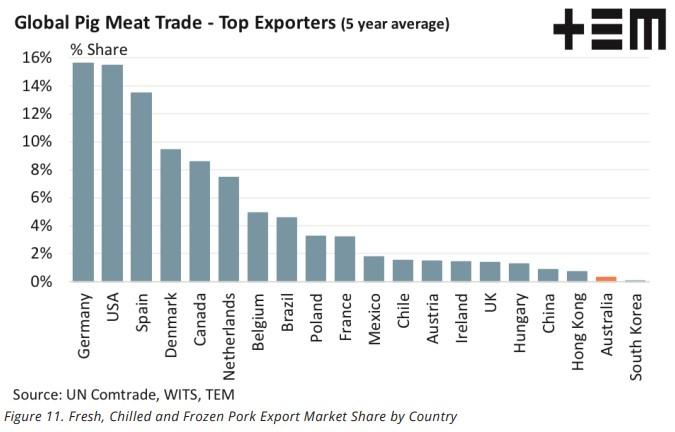

Exports

The USDA expects Australia’s export volumes to remain stable at 40,000 MT (CWE) in 2022, up 2,000 MT (CWE) from 2021 and in line with its official forecast.

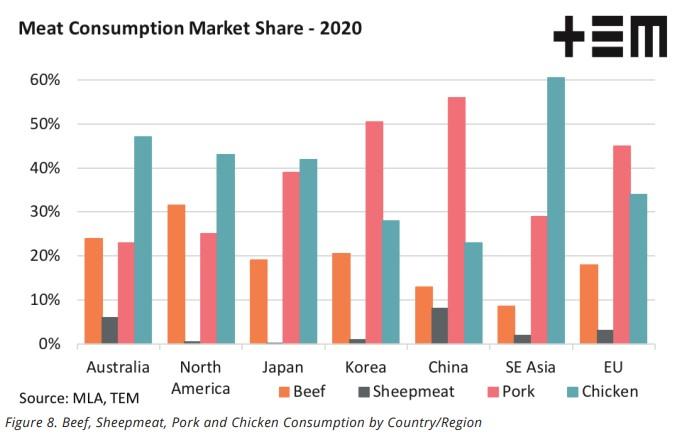

It notes Australian pork exports are relatively low at around 9 per cent of production, with more than 90 per cent shipped to seven countries in Asia.

Singapore is the most important destination with around one-third of overall exports, followed by Papua New Guinea, New Zealand and the Philippines, which each accounted for 12 to 15 per cent of total exports in 2021.

“The Philippines and South Korea significantly increased as export destinations while Vietnam and Hong Kong decreased. Pork exports for 2021 were at 38,000 MT (CWE),” the USDA reports.