MLA Predicts Strong Growth In Sheep Production And Sheep Sales

Sheep Production And Sheep Sales Forecast To Strengthen

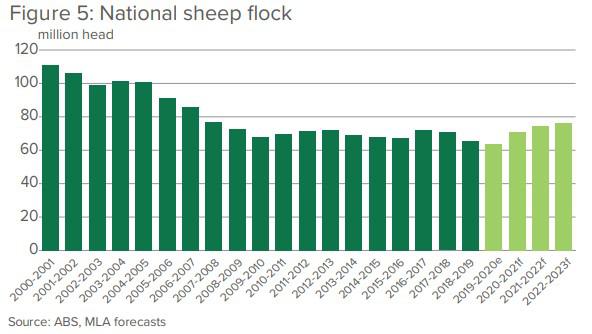

The national sheep flock is predicted to grow by 4.9 per cent to 74.4 million head in 2022, fuelling strong growth in slaughter volumes, production and exports in both 2022 and 2023, according to Meat & Livestock Australia’s (MLA) latest Sheep Industry Projections.

Click on any of the following links to go straight to MLA's detailed analysis of the sector's key performance indicators, including:

National Flock

Slaughter

Carcase Weights

Production

Live Exports

Export Markets

Domestic Consumption

Prices

Headwinds

Looking Ahead

National Flock

Continued strong seasonal conditions across the key sheep-producing states of New South Wales and Victoria, as well as a favourable autumn and winter rainfall for Western Australia in 2021, are the key drivers in boosting the flock’s growth in 2022, according to the MLA.

In 2021, the sheep flock was at its largest size since 2017 with a projected total of 70.9 million head; and is forecast to expand by 4.9 per cent to 74.4 million head in 2022, its highest level since 2013.

Encouraging weather conditions, particularly in the eastern states, are consistent with the sentiment of a recent MLA survey which indicated 95 per cent of producers are looking to increase or maintain their ewe flock over the next nine months.

“Disruptions caused by COVID-19 have had periodic impacts on an otherwise very strong sheep market. As a result of various supply chain disruptions as well as the favourable conditions, early 2022 indications would suggest that producers have held back on turning off lambs destined for processing,” MLA said.

When compared to 2020 yardings, MLA said the 2021 lamb yardings indicate significant growth in the year’s lamb cohort and the national flock, as was predicted in its October Sheep Projections.

National lamb yardings rose by 11 per cent or 903,000 head year-on-year overall, with NSW the key driver, lifting its lamb supply by 15 per cent or 647,000 head.

Victorian yardings rose more mildly, by 6 per cent or 179,000 head. Meanwhile, in the west, lamb supply strengthened 5 per cent overall, equivalent to 27,000 head.

For sheep, MLA said yardings nationally were firm reflecting what was happening in the key states of NSW and Victoria. South Australia painted a different picture due to its challenging seasonal conditions, with numbers rising by 18 per cent or 39,000 head year-on-year.

In Tasmania, producers are building their flock size, according to MLA, with sheep yardings softer compared to 2020 by 19 per cent or 13,000 head as producers look to capitalise on strong seasons and build their sheep flocks.

MLA said a key highlight was the positive attitude of producers in WA, with strong intentions to rebuild their numbers. The state’s yarding volumes validate this, with volumes down 9 per cent or 50,000 head year-on-year as producers look to utilise mature breeding ewes to build flock numbers following a strong autumn/winter rainfall period in 2021.

“Considering Victoria’s lamb yardings were marginally stronger in 2021, this yarding data would indicate a large volume of lambs have been held back by producers in 2021. As a result, these numbers should come onto the market in the first half of 2022,” MLA concluded.

Slaughter

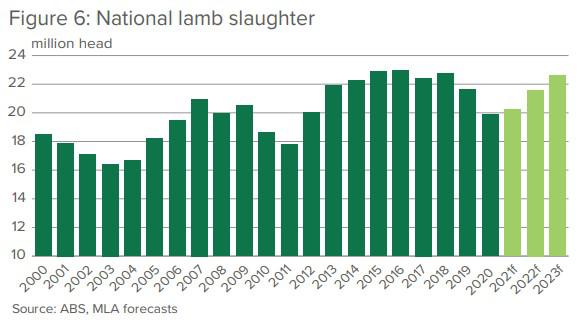

In 2021, lamb slaughter was predicted to reach 20.25 million head, approximately 350,000 head higher than 2020.

Due to the large size of the 2021 lamb cohort, MLA expects a promising influx of lambs to hit the market in early 2022, with lamb slaughter expected to reach 21.6 million head in 2022.

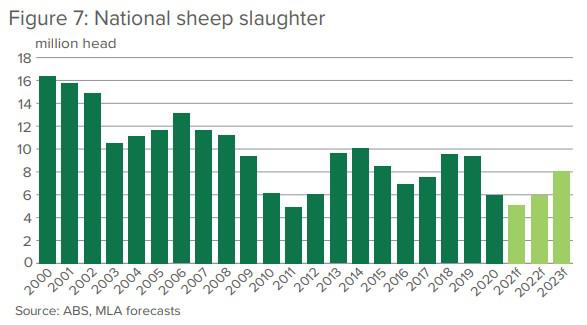

Meanwhile, MLA anticipates sheep slaughter to reach six million head in 2022, marking a 17.6 per cent increase, or 900,000 head, on 2021 levels.

“These projections for higher sheep slaughter represent the maturation of the Australian sheep flock rebuild and follows consecutive years where older ewes have been retained on-farm,” MLA said.

Carcase Weights

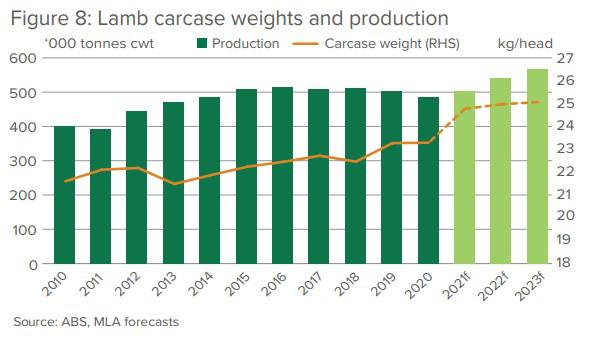

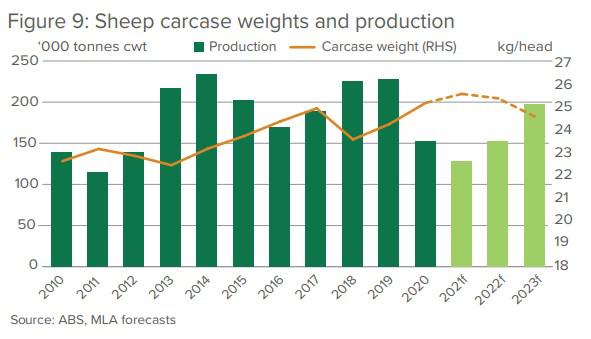

MLA isn’t forecasting significant changes to carcase weights in 2022.

With an abundance of feed across the key lamb-producing regions of eastern Australia during both 2020 and 2021, it predicts average national lamb carcase weights are expected to gain a modest 0.2kg to reach 25kg in 2022.

MLA noted that price premiums for trade and heavy-weight lambs continue to provide producers with an incentive to add additional kilos to animals.

“In line with the increase in carcase weights, the Heavy Lamb Indicator averaged 845¢/kg cwt in January 2022 – a 2.5 per cent and 12.1 per cent increase on 2021 and 2020 prices respectively,” it added.

Production

MLA’s Market Information Manager, Stephen Bignell, said production is set to increase in the next few years to record levels, driven by growing lamb slaughter volumes and stabilising, but historically high, carcase weights.

“In 2023 it is predicted that production for lamb will be at an all-time high of 567,000 tonnes which will subsequently flow through to higher exports,” he said.

And despite sheep carcase weights for 2022 being forecast to drop by a marginal 0.3kg/head from 2021 levels to 25.3kg, MLA forecasts sheep production is set to reach 152,000 tonnes cwt in 2022, marking an increase of 24,000 tonnes.

Live Exports

In contrast, MLA suggests the current outlook for Australian live sheep export in 2022 is subdued, with high sheep prices and the summer export prohibition the major restrictions on the trade.

It added that the rebuild of the national flock in response to improved conditions in many sheep-producing areas has reduced supply of sheep suitable for live export.

“Depending on the effect that the WA flock rebuild will have on increasing supply and easing prices from mid-year, exports may be stronger from September when exports to the Gulf can resume,” MLA said.

“Exports for 2022 are anticipated to be similar to 2021. In 2021, a total of 575,529 head of sheep were exported, 29 per cent fewer than in 2020 and 13 per cent fewer than earlier forecasts. This is the lowest number since 1969 when 396,519 head were exported.”

MLA added the absence of Australian sheep exports to the Middle East and North Africa (MENA) markets for three months of the year (June to September) for over three consecutive years has forced importers to source alternative year-round supply.

In 2021 exports to Kuwait were steady, with higher volumes going to the United Arab Emirates, Oman and Israel. However, Qatar – once a major export market – saw zero trade in 2021 after the Qatar subsidy removal took effect from January 1, 2021.

On a positive note, MLA said that despite the supply challenges, MENA markets appreciate the high quality of Australian sheep.

“Long-term demand for live sheep remains strong in the region and is gradually recovering to pre-pandemic levels as social gatherings and tourism for the purposes of business, leisure and Hajj resume. Indications are that as Australian sheep prices ease, exports will grow again,” it suggested.

Export Markets

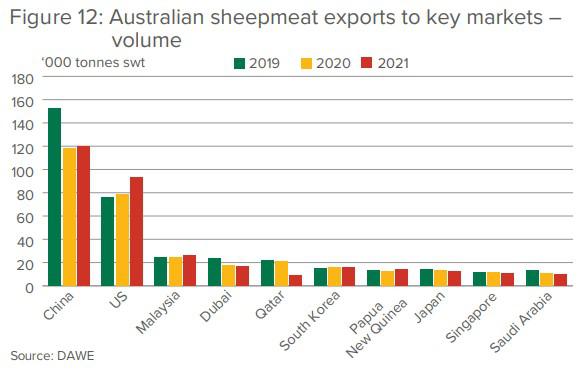

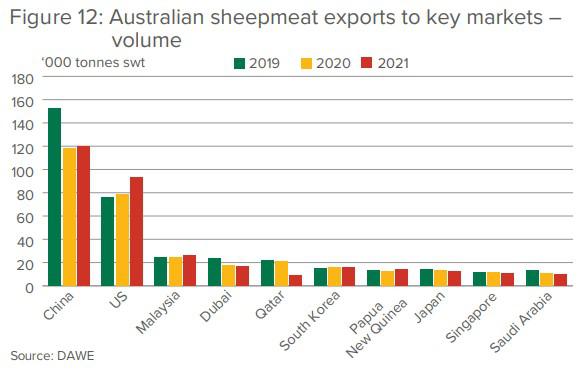

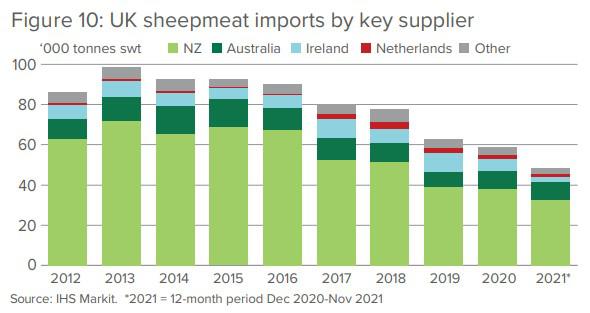

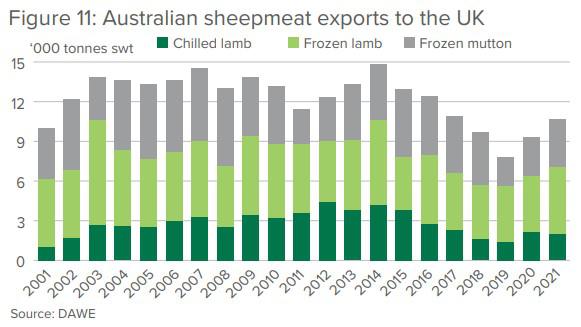

MLA said 2021 saw more than one million tonnes of sheep meat exported globally, down 6.1 per cent on 2020 volumes, with Australia the largest exporter ahead of New Zealand and the UK.

China remained the largest import market for sheep meat at 372,000 tonnes, followed by the US, which imported over 115,000 tonnes, and the UK, at 43,000 tonnes, it added.

Australia’s sheep-meat exports increased by 0.5 per cent, though the overall value rose by 5.3 per cent to $3.96 billion on the back of a strong increase in the unit value.

The volume of chilled sheep-meat exports dropped by 12.2 per cent in the year, while frozen exports increased by 4.9 per cent. Lamb represented 65.3 per cent of total exports.

Total global consumption of sheep meat is projected to grow 14 per cent by 2030 to 18,395,000 tonnes a year, according to OECD-FAO. MLA said most of this demand is expected to be met by increased domestic production.

Despite this, MLA said there will still be considerable opportunities for Australian exporters.

“Many of our long-term trading partners are expected to increase consumption while export volumes remain flat globally,” it noted.

“Malaysia is projected to consume 23.6 per cent more sheep meat by the end of the decade, while still relying entirely on imports. Given the long, stable relationship Australian exporters have built with Malaysian retailers, as well as the tariff-free access Australian exporters enjoy in the Malaysian market, Australia is well-positioned to meet future needs in this market.

“The US is projected to maintain consumption at current levels, but production has fallen consistently over the past three years due to shifting climate and land-use patterns. Given this, the United States is likely to remain a substantial importer of sheep meat for the foreseeable future.

“In addition, the long-term increase in dairy production and exports in New Zealand has effectively reduced sheep-meat export capacity. This trend is likely to continue as demand for milk solids increases in China.

“This means that despite marginal increases in demand globally, the supply of sheep meat available for export is likely to decrease over the coming decade. In positive news, Australia is likely to emerge as the only country with the production and transport infrastructure available to meet transient supply challenges over the next decade.”

Over the decade, MLA said Australian sheep-meat exports are projected to increase by 20 per cent to 488,000 tonnes a year in 2031.

Domestic Consumption

With uncertainties and trade tensions in the international markets, MLA said the importance of the domestic market is increasing.

However, it noted domestic consumption has been dropping since 2015, down from 60,645 tonnes in the March quarter of 2015, to 39,751 tonnes in the September quarter of 2021, driven by a 40 per cent jump in retail prices over the period.

It noted, though, that in 2021 the retail price of lamb remained relatively stable, compared to the 11 per cent growth of the beef and veal retail prices. Chicken and pork saw a decline of 0.4 per cent.

“The relative price change among the major proteins suggests consumers are shifting their consumption towards cheaper meats. The volume share of fresh lamb has reduced by 0.4 per cent over the period of June, July and August compared to the same period two years ago, while chicken has gained an additional 2.5 per cent volume share followed by pork which increased by 0.9 per cent,” MLA said.

Prices

MLA said the 2022 saleyard prices for sheep-meat categories are mixed, however, they are outperforming the long-term historical averages.

“While processors haven’t been as active in saleyards as usual during the month of January, prices have begun 2022 strongly, backed by the international demand for Australian lamb and mutton in key established global markets,” it noted.

Headwinds

MLA predicts labour shortages are expected to be an area of significant concern for the red meat industry right across the entire supply chain in 2022, affecting the availability of farm hands and managers, through to boning room staff in processing plants as well as truck drivers, as well as putting pressure on wage costs.

On top of this, the industry faces major supply chain and logistics challenges in getting product to the desired market and the cost of freight.

“These freight developments have had two main effects: the price of shipping has increased dramatically and certainty around scheduling has collapsed,” MLA said.

“The price of insurance has increased as uncertainty around arrival and departure times can negatively affect product value, and the potential for delays adds the risk of contract failure, triggering fines that can further increase costs.”

Looking Ahead

MLA said slaughter volumes were softer than usual for the traditionally busy January month. Processing constraints, as well as excellent pasture cover and availability, has allowed producers to hold lambs back from market, it noted.

“Therefore, a large increase in lamb supply is expected within the next three to four months in certain states, possibly placing pressure on prices,” MLA said.

“There is continued support for Australian sheep meat globally and economies are continuing to recover and grow. As a result, the outlook for Australian sheep meat, both on a domestic production level and within the established and emerging global markets, is extremely positive.

“Challenges will influence fluctuations in the market but overall, as the previous two years have shown, the Australian sheep-meat industry will remain resilient across the entire supply chain and manage these challenges to support the delivery of product across the globe.

“Overall, Australia’s sheep-meat industry is positioned to strengthen, and confidence remains high across most parts of the industry, including the production end where seasonal conditions and overall historical market prices have never been more favourable.”

Click on the following link to check out more than livestock properties for sale in Australia.