Value Of Sheep Sales Forecast To Reach New Records: ABARES

Rising Prices And Production Set To Push Sheep Sales To New Record

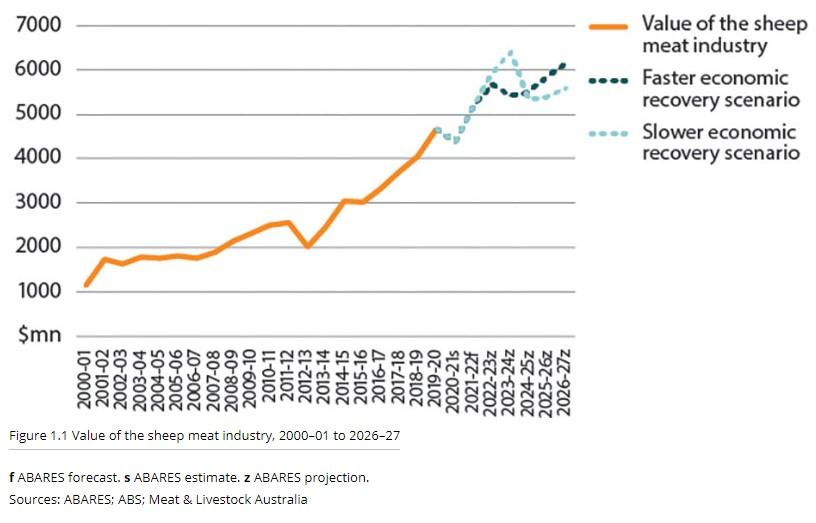

The gross value of Australian sheep sales is forecast to break a new record of more than $5 billion in 2021-22, supported by record high prices and rising sheep meat production, according to the Australian Bureau of Agricultural and Resource Economics and Sciences' (ABARES) just-released Agricultural Commodities Report.

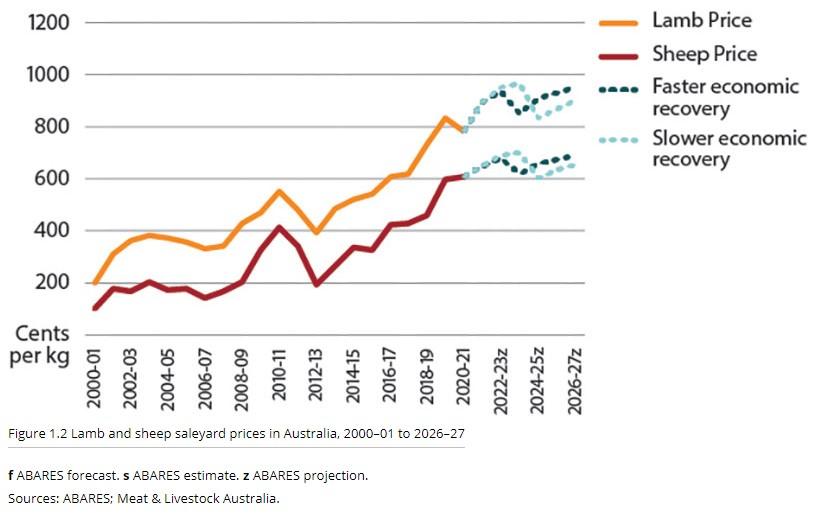

With global inflation expected to ease by the middle of 2022 and global incomes expected to rise, ABARES says lamb prices are expected to increase by 5 per cent, averaging 934 cents per kg in 2022-23. Sheep prices are expected to average 678 cents per kg in the same year, it adds.

ABARES notes a longer period of inflation would support sheep meat prices in the short term to 2023-24, but weigh on prices over the medium term to 2026-27.

By 2026-27, it predicts the value of the sheep meat industry to range between $5.6 billion and $6.1 billion, depending on the path of global economic recovery.

Sheep Sales: Slaughter & Production

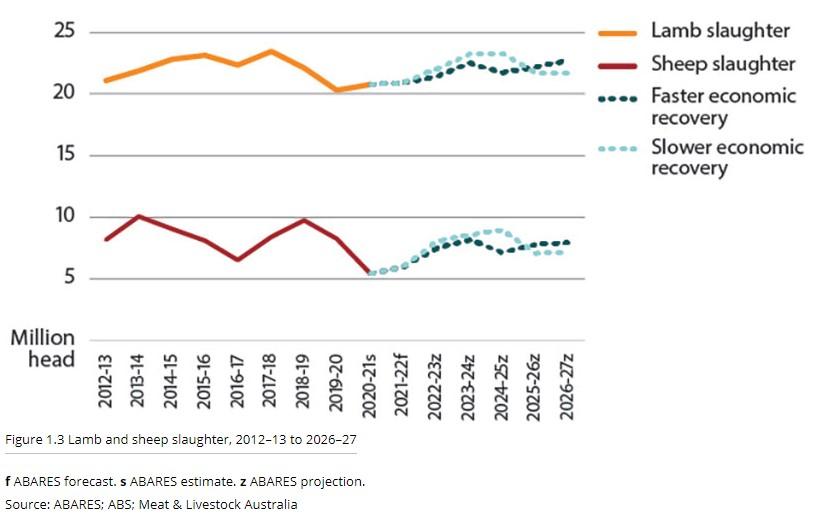

In 2021-22, the quantity of sheep meat produced in Australia is expected to rise by 5 per cent to around 690,000 tonnes, due to rising numbers of sheep and lambs slaughtered, ABARES says.

Lamb slaughter is expected to rise by 1 per cent to 21 million head in 2021-22, it suggests, while sheep slaughter is expected to rise by 11 per cent to six million head, on the back of ongoing flock rebuilding.

ABARES’ Harry Coë notes the outbreak of the Omicron variant of COVID-19 weighed on slaughter levels in January, with lamb slaughter volumes down 20 per cent year-on-year and sheep slaughter down 32 per cent, however both recovered to pre-Omicron levels in February.

He says sheep meat production is expected to rise over the medium term to 2026-27, in line with rising slaughter, reaching around 750,000-780,000 tonnes.

Lamb slaughter is expected to be around 21.7-22.7 million head by 2026-27, while sheep slaughter is expected to be around 7.2-7.9 million head, Coë says.

“Slaughter is expected to rise more quickly in the slower economic recovery scenario than in the faster economic recovery scenario, since Australian sheep meat producers are expected to take advantage of high global prices in the short term,” he adds.

“However, higher slaughter will lead to a decline in the Australian sheep flock size. Therefore, by 2026-27 slaughter is higher in the faster economic recovery scenario as there are more sheep available.”

In both scenarios, Coë says sheep meat production is expected to be constrained by the small Australian sheep flock, which has fallen from 72 million in June 2017 to 63.5 million in June 2020.

“By 2026-27, the flock size is expected to recover to 75.1 million sheep. However, it could be as low as 68.5 million sheep in the slower economic recovery scenario due to higher slaughter rates early in the outlook period,” he says.

Sheep Sales: Exports

In 2021-22, the increase in sheep meat production is expected to lead to higher export volumes, which ABARES forecasts to rise by 12 per cent to around 480,000 tonnes.

By value, exports are predicted to reach $4.4 billion in 2021-22, driven by strong sheep meat exports to the United States. It notes between July and November 2021, exports to the US were 45 per cent higher than the same time in 2020, fuelled by strong price growth and relatively low domestic production.

Between 2022-23 and 2026-27, the value of Australia’s sheep meat exports is expected to continue rising, ABARES says, to hit between $4.6 billion and $5.1 billion.

“In the slower economic recovery scenario, meat prices in the US are expected to continue rising faster than general inflation over the next two years. US meat vendors are expected to receive higher returns for their product at the supermarket. This will encourage US meat vendors to pay more for imported meat, such as sheep meat from Australia,” Coë says.

“Meanwhile, in the Middle East higher oil prices will lead to rising incomes in the short term. This will allow the region’s sheep meat demand to recover more quickly.”

In a slower economic recovery scenario, US sheep meat demand is forecast to start easing around 2024-25 as central bank measures to control inflation weigh on economic growth and consumer spending.

“As a result, the value of Australian sheep meat exports is expected to be about $500 million lower by 2026-27 in the slower economic recovery scenario,” Coë adds.

ABARES adds that sheep meat exports to China are forecast to increase in 2021-22, driven by increasing incomes and urbanisation; plus the lingering impacts of African swine fever.

It also notes that in the short term to 2023-24, global demand for Australian sheep meat will be supported by lower production in New Zealand, the largest exporter to China and the second-largest exporter to the US.

Sheep Sales: Prices

In 2021-22, ABARES says lamb saleyard prices are expected to increase 14 per cent to 893 cents per kg, supported by strong export demand from the US; while sheep saleyard prices are expected to rise 7 per cent to 648 cents per kg.

“If the pace of the global economic recovery is slow, prices are expected to continue increasing until 2023-24, as higher global inflation supports global demand for sheep meat,” Coë says.

“However, over the medium term to 2026-27, domestic lamb and sheep prices will also be influenced by seasonal conditions. Although the timing of a dry year is uncertain, the occurrence of drought-like conditions is expected to weigh on saleyard prices in both scenarios.”