Sheep Sales Prices Continue Downward Trajectory

COVID-19 Outbreaks Hit WA Sheep Sales Prices

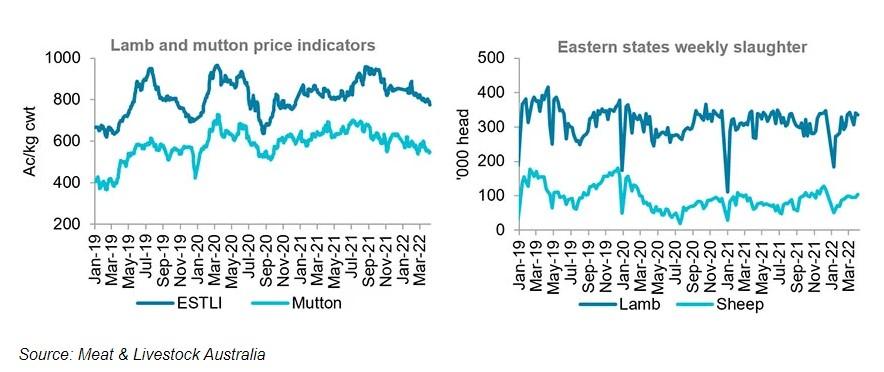

The downward trajectory of Australian lamb prices continued over the last month, with the Eastern States Trade Lamb Indicator steadily declining to 775c/kg in early April, its lowest point since December 2020; and the Western Australia Trade Lamb Indicator falling 16.1 per cent from the start of March to below 700c/kg, according to Rural Bank’s April ‘Insights’ report.

The decline in the eastern states’ indicator took it to 3.4 per cent below early March and 12.7 per cent lower from a peak in late January.

Rural Bank says the more pronounced decline in WA trade lamb prices was a result of staff shortages in processing facilities due to COVID-19 outbreaks.

Mutton prices are also lower month-on-month, it adds, with the National Mutton Indicator briefly ring to 600c/kg in mid-March but since falling below 550c/kg. It is currently down 6.2 per cent month-on-month and 17.8 per cent from a year ago.

“Prices declined under the weight of additional lamb and sheep supply in eastern states. Average weekly lamb slaughter in eastern states was 4.6 per cent higher month-on-month in March while sheep slaughter was 3.6 per cent higher,” the bank says.

“The steady upward trend in slaughter rates suggests the processing challenges have largely been resolved. Eastern states slaughter typically rises until the end of autumn. Supply is expected to rise in-line with this pattern with plenty of lambs from last season yet to hit markets.

“It was a different story in Western Australia where processing challenges have only recently presented themselves. This drove Western Australian weekly lamb slaughter in the first week of April to be 40.6 per cent lower month-on-month.”

Rural Bank notes increased Australian lamb production is flowing to export markets where it is being met by strong demand. Lamb export volume in March was up 17.7 per cent from February and 7.9 per cent higher than a year ago.

It says demand from the US strengthened in March with a 28.6 per cent lift in volume from February, helping to mitigate a 10.5 per cent decline in exports to China where export volumes in the first quarter of 2022 were down 24.1 per cent year-on-year.

Lamb exports to the Middle East improved by 32.3 per cent in March to sit 9.1 per cent higher year-on-year thanks to growth to Saudi Arabia and the UAE, however, volumes to the Middle East remain subdued, down by nearly 50 per cent compared to 2019, the bank reports.

Rural Bank says mutton exports have not seen the same uplift as lamb exports with year-to-date volumes only 2.3 per cent higher year-on-year. China remains the largest market, but volumes are down 21.7 per cent year-on-year.

On the bright side, it notes Malaysia has overtaken the Middle East as Australia’s second-largest mutton market courtesy of a 46.9 per cent increase from 2021.

“Lamb and mutton prices are expected to trend lower in the coming month as supply continues to trend higher. However, producers should remain confident in the longer-term outlook on the back of strong export demand and a favourable outlook for seasonal conditions for the remainder of autumn,” Rural Bank concludes.

Find livestock properties & sheep properties for sale on Farmbuy.com