National Sheep Flock Forecast To Grow

Survey Finds One-Third Of Producers Expect to Expand Flock

Almost one-third (31 per cent) of sheep and lamb producers are looking to increase their flocks, 60 per cent are going to maintain flock numbers and seven per cent are going to reduce their flocks, according to the latest Meat & Livestock Australia (MLA)/Australian Wool Innovation (AWI) sheep meat and wool survey.

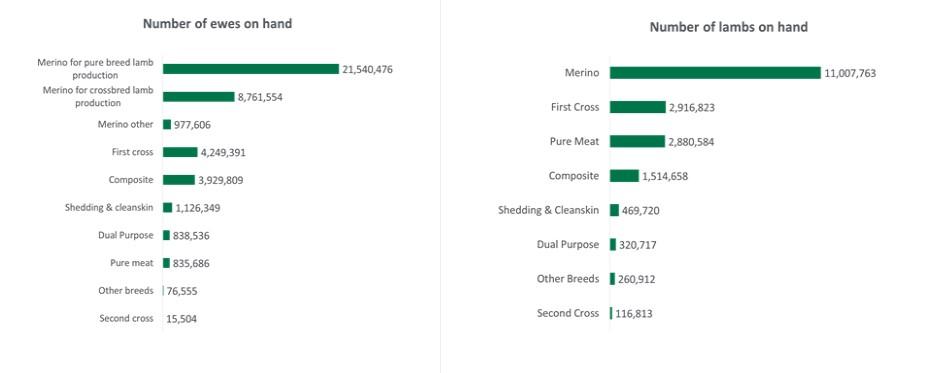

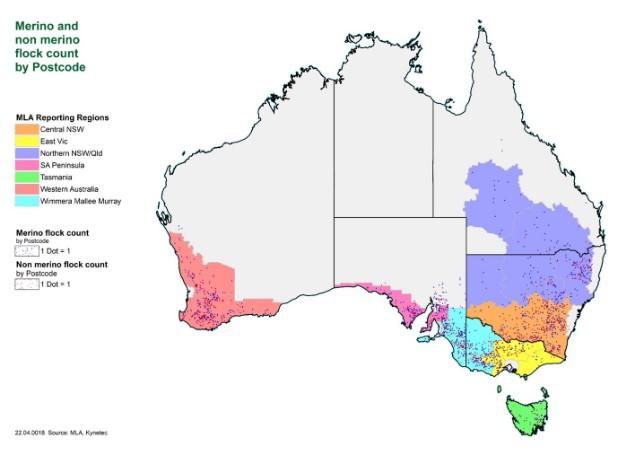

The results of the February 2022 survey found there was a total of 42,351,464 breeding ewes on hand (which can give an indication of producer intentions, including whether there is a push towards wool or meat producing breeds), including 74 per cent Merino (or wool producing), and 26 per cent non-Merino.

Breeding ewe numbers have increased by 1.1 million head as the flock growth continues.

Meanwhile, the survey found lamb numbers on hand (which can provide insight into producer intentions for the year ahead) topped 19,487,990, comprising 56 per cent pure-bred Merino and 44 per cent non-Merino.

There were 1.1 million head more breeding ewes this year – three per cent up year-on-year. MLA says this indicates there will be increased activity in the mutton market throughout the rest of the year.

In NSW, the number of breeding ewes increased eight per cent to 17.6 million but there are 15,300 less lambs on hand. This is the largest increase in breeding ewes across the nation year-on-year.

The survey found that between November 2021 and February 2022 there have been 5.3 million lambs marked – 63 per cent Merino, 16 per cent pure meat and nine per cent first cross.

There were 5.8 million ewes joined with national marking rates at 83 per cent for Merino breed and 99 per cent for non-Merino breeds, it found.

Of the 8,031,561 expected sales (which can give an indication of the future make-up of the national flock), the survey found 32 per cent are forecast to be Merino, 27 per cent pure meat, 25 per cent first cross and all other breeds making up 16 per cent.

Find more livestock properties for sale on Farmbuy.com