Regional properties for sale attract record prices: Corelogic

Regional Property Prices Up 40pc In Just Two Years

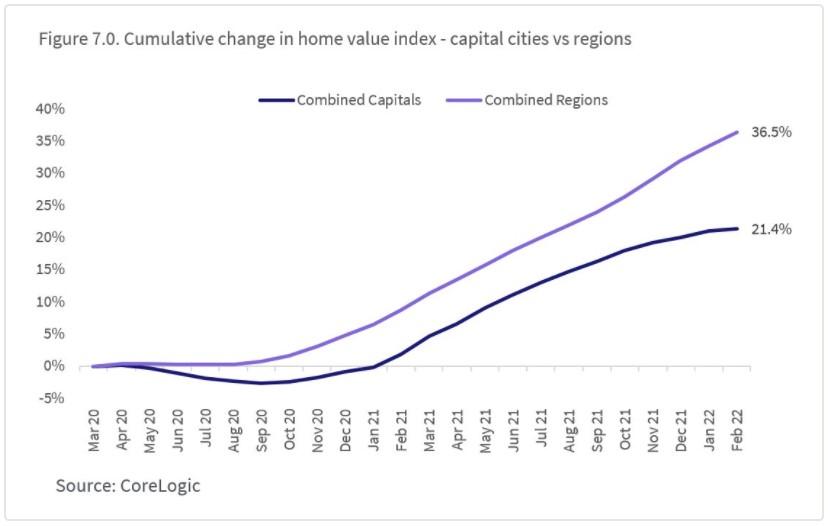

Property values across regional Australian have jumped almost 40 per cent since March 2020, near-on double the rate of capital city home values (+21 per cent), according to Corelogic’s Head of Residential Research Australia Eliza Owen.

In an analysis of “six ways COVID-19 has shaped the housing market” over the past two years, she notes “migration trends over 2020 and 2021 revealed an uptick in the volume of people leaving cities for regions outside of lockdown periods, and a decline in people leaving regions for cities”.

“The result has been higher than normal housing demand against unusually low levels of listings across regional Australia, in both the sales and rental market.

“Value gains across regional Australian dwelling values has been almost 40 per cent since March 2020, while capital city home values have increased around 21 per cent,” Owen says.

The five other ways COVID-19 has shaped the property market over the past 24 months are:

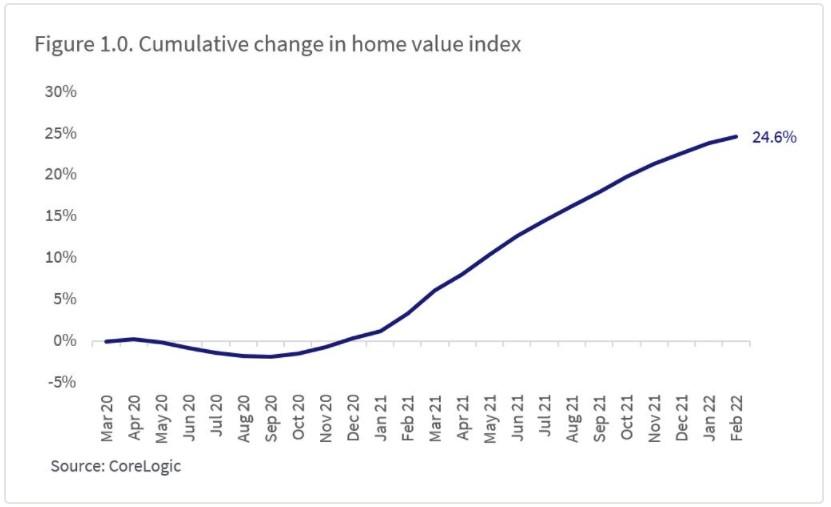

1. Australian Home Values Rose 25pc, To Record Highs

Despite an initial dip, housing values rose 24.6 per cent between the end of March 2020 and February 2022, Owen says.

While national home values declined 2.1 per cent between April 2020 and September 2020, they then soared amid low interest rates, high household savings, government grants and a sharp reduction in the supply of housing.

“By February 2022, CoreLogic estimated the total value of residential real estate to be $9.8 trillion, up from $7.2 trillion at the onset of the pandemic. The median Australian dwelling value increased $173,805, to $728,034,” Owen adds.

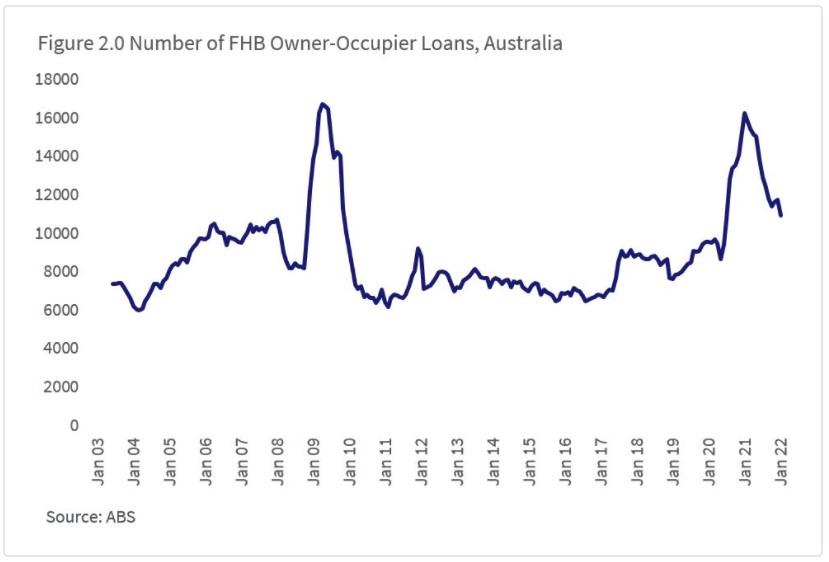

2. First Home Buyer Activity Spiked

First home buyers were a sizable part of housing demand at the start of the pandemic, according to Owen. This cohort took advantage of more affordable housing options following the earlier downturn, along with record low mortgage rates and government incentives, she notes.

“ABS data shows the number of new loans to first home buyers increasing during the housing market downswing from 2017 to 2019. From June 2020, first home buyer activity surged amid the introduction of the HomeBuilder scheme, used alongside the First Home Loan Deposit Scheme, as well as other state-based grants and stamp duty concessions for first home buyers,” she explains.

“The result was a spike in first home buyer activity, which peaked in January 2021. Since the January 2021 peak, first home buyer activity has diminished, reflecting higher barriers to entry as housing values substantially outpace incomes.”

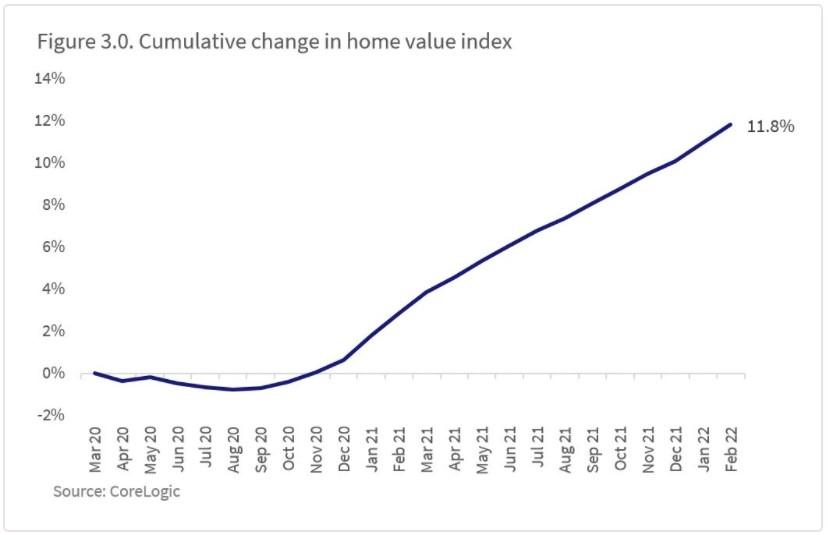

3. Rents Rose 11.8pc To Record Highs, While Gross Yields Fell To Record Lows

Owen says the CoreLogic Rent Value Index, which tracks changes in rental valuations over time, has also surged to new record highs.

While rents saw a mild decline of 0.8 per cent between March and August 2020, there was a swift recovery in these values, followed by a surge through 2021.

There are multiple reasons rents have risen, Owen says.

She notes investor activity was relatively subdued between 2017 and mid-2020, contributing to rental supply constraints. Rental supply may also have been eroded through the rise of rental services like Airbnb, which have enabled property owners to pivot to the short-term rental accommodation market.

Over the course of 2021, annual rent value growth was at its highest levels since 2008. Across Australia, median advertised rents since March 2020 have increased $30 per week to $470 per week.

However, Owen points out that gross rental yields have declined due to the surge in property prices, with purchase prices +24.6 per cent since March 2020, outpacing the +11.8 per cent rise in rents.

“Nationally, gross rental yields have fallen from 3.8 per cent at March 2020 to a record low 3.21 per cent as of February 2022. As housing growth has started to slow, this record-low gross rent yield figure appears to have begun stabilising,” she says.

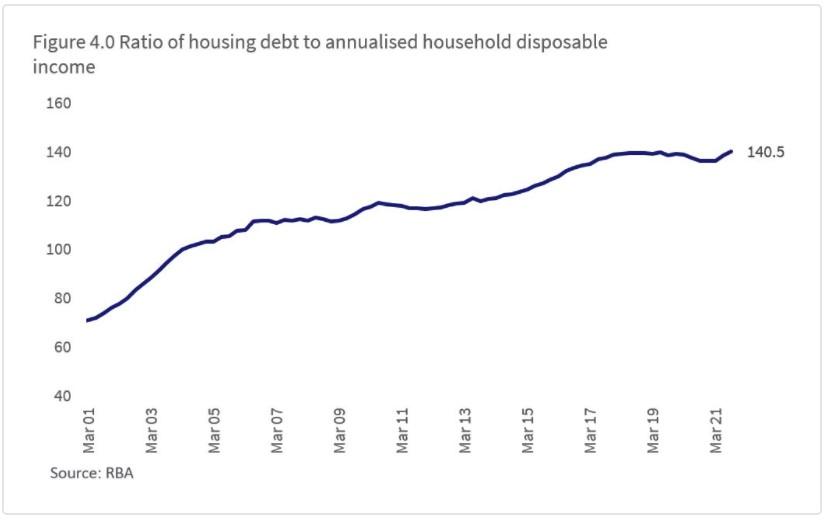

4. Housing Debt Levels Hit Record Highs

As of January, Owen says total outstanding housing credit sat at a record high of more than $2 trillion, according to the RBA, while the ratio of housing debt to household income was at a record high 140.5 per cent through Q3 2021, up from 139.2 per cent in March 2020.

ABS data shows monthly new finance borrowed for the purchase of property continued to hit fresh record highs through January 2022, at $33.7 billion, she adds.

“High levels of housing debt, particularly where it has grown faster than incomes, creates a vulnerability in the Australian economy.

“However, it is important to frame debt levels in the context of high asset values, and relatively low interest costs. RBA data shows housing interest payments to income have fallen to their lowest levels since 1999, and household debt has trended lower as a portion of housing values,” Owen says.

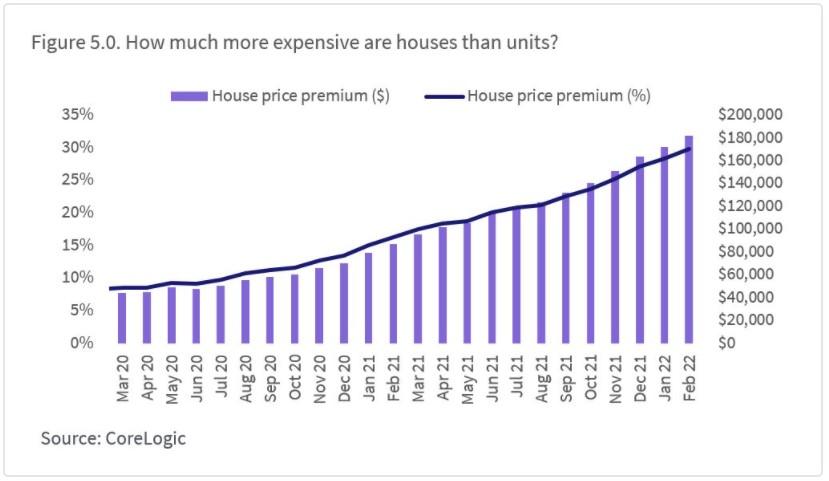

5. The Premium Of House Prices Compared To Units Hit Record Highs

Both the composition of the buyer pool and the impacts of COVID-19 may have contributed to a record gap between house and unit values, Owen believes.

She notes investors, who may have a preference for units, have been a relatively small part of demand through the upswing. Additionally, detached houses may have been in higher demand as Australians spent more time at home through the pandemic.

“Government policies such as the HomeBuilder grant may have also contributed to increased detached housing demand, due to tight construction timelines to qualify,” Owen adds.

“The result is a record high gap between house and unit values … the median house value across Australia was at a record high 29.8 per cent above the median Australian unit value, with a dollar value premium of around $182,000. This is up from just 8.5 per cent in March 2020, or a dollar value premium of around $44,000 for houses.”

Find more acreage/semi-rural properties, cropping, dairy farms, hobby farms, lifestyle properties, residential blocks and mixed farming properties for sale on Farmbuy.com