Australian Goat Production Rebounds On Improved Weather Conditions

Improved Condititons Fuel Growth In Australian Goat Production

Australian goat production has rebounded after several years of adverse environmental conditions impacting supply volumes, according to Meat & Livestock Australia’s (MLA) just-released Global Goatmeat Snapshot for 2022.

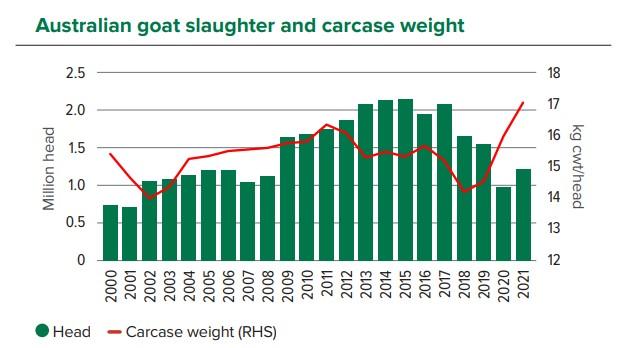

The report says sustained favourable conditions since 2020 have triggered an expansion in the flock size, flowing on to increased production. Last year saw an end to the downward trend in slaughter which had been occurring since 2015.

The rise in production reflects an increase in the number of animals as well as heavier animals, resulting in heavier carcase weights, it says.

According to MLA’s National Livestock Reporting Service (NLRS), eastern states goat slaughter increased 42 per cent year-on-year in 2021, totalling 1,006,292 head, including:

- Queensland totalled 401,570 head, 41 per cent more than 2020;

- Victoria totalled 394,711 head, 71 per cent more than 2020;

- SA processed 123,326 head, four per cent more than 2020; and

- NSW processed just over 86,685 head, 20 per cent more than 2020.

MLA reports that goatmeat production in 2021 increased 34 per cent on the previous year, totalling 20,847 tonnes carcase weight (cwt). Average carcase weights lifted seven per cent year-on-year, to 17.02kg/head in 2021, contributing to the increase in production.

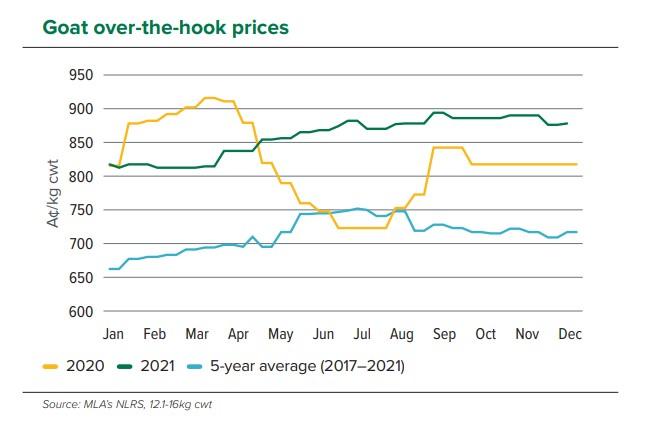

After reaching record levels in 2019, goat over-the-hooks pricing remained historically high in 2021, trending steadily upwards from March and averaging 859¢/kg cwt for the year.

Exports

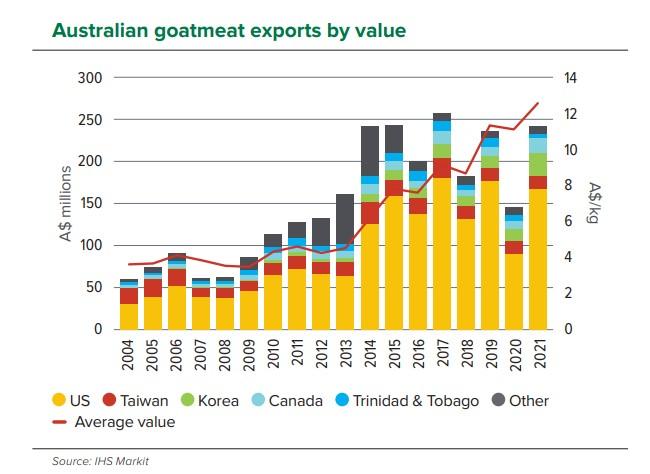

Australia is a minor goatmeat producer in the global context but stands out as the world’s top exporter, with a 34 per cent value share and 27 per cent volume share of global goatmeat exports in 2020, MLA says. Australian goatmeat is almost exclusively (98.5 per cent) exported as a frozen whole carcase, it adds.

MLA notes that despite pandemic-related disruptions across distribution and sales channels, demand for Australian goatmeat in international markets is strong, driving annual export unit prices to record highs.

It reports that in 2021, Australia exported a total of 19,046 tonnes shipped weight (swt) of goatmeat, up 34.5 per cent year-on-year. Despite the disruptions in the foodservice channel – the main channel for Australian goatmeat – international demand is strong and combined with Australia’s tight supply, has sustained high prices.

Australian goatmeat exports were valued at $242 million in 2021, up 67 per cent on 2020, MLA says.

Notably, it points out the ranking of Australia’s top-five export markets has changed over the past year.

The US remains by far the most important market for Australian goatmeat, accounting for 66 per cent of exports by volume in 2021 at 12,589 tonnes – 47.5 per cent more than in 2020. This is set to continue, MLA says, driven by population growth, demographic change and evolving consumer tastes.

Canada is a fast-growing market, accounting for 6.7 per cent of export volume in 2021, an increase of 35 per cent over 2020 volumes. Exports to Canada in 2021 were up 38 per cent on 2019 pre-pandemic levels at 1,279 tonnes swt.

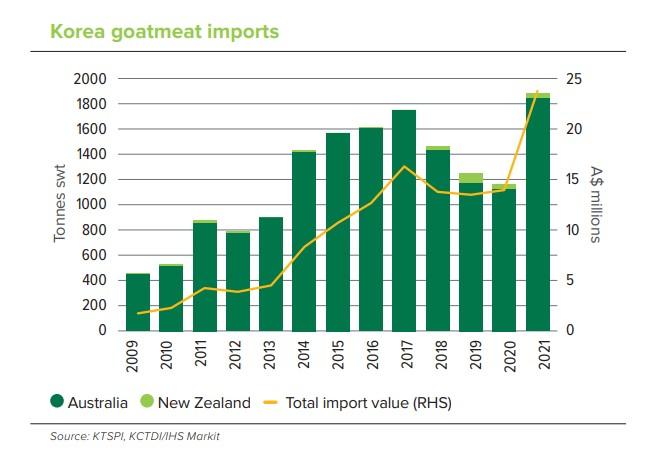

In 2021, South Korea suddenly grew 91 per cent year-on-year to 2,128 tonnes, overtaking Taiwan as Australia’s second-largest export destination, according to MLA.

This recent growth is attributed to an influx of Nepalese and Chinese workers who enjoy goatmeat and a rise in the price of local black goats used for medicinal purposes, which has increased manufacturing demand for cheaper imported products and attracted new importers into the trade.

Similarly, Japan imported 458 tonnes, displacing Trinidad and Tobago in the top-five markets. In 2021, the Caribbean region represented around 2.5 per cent of Australia’s goatmeat exports, according to MLA. At 439 tonnes shipped weight (swt), valued at $5.4 million, this was the lowest volume since 2000, driven by a combination of tight supply and demand from other markets, plus the pandemic’s impact on its tourism sector.

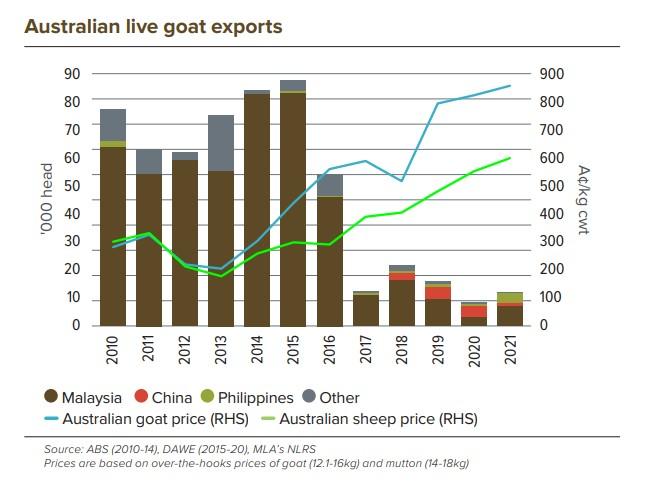

MLA notes that Australian live goat exports accounted for 2 per cent of total goat export value in 2021, at $5.1 million. In 2021, Malaysia recovered its historical position as the top export market, with a mix of slaughter and breeder goats.

While China became Australia’s largest live goat export market in 2020, exports fell in 2021 to just 819 head, MLA says.

Meanwhile, demand for breeders in the Philippines surged to a record high of 3,500 head in 2021.

Live Exports

MLA says Australia’s live goat exports have been declining over the past few years, from a peak of 88,000 head in 2015 to 8,400 head in 2020.

However, live goat exports grew 43 per cent year-on-year to 12,018 head in 2021, as a result of an increase in supply but also demand, particularly in the key market of Malaysia and demand for breeders in the Philippines.

MLA notes that, historically, Malaysia has been the largest export market for Australian live goats. In recent years, tight supply and higher prices have made live goats less competitive compared to domestic goat, domestic sheepmeat and imported mutton, it notes.

In 2021, Malaysia imports grew 113 per cent year-on-year to return to being the top destination with 7,393 head, driven by stronger demand generated by the popularity of this protein in religious celebrations such as Eid, and the recovery of wet market supply chains to pre-pandemic operations.

Domestic Market

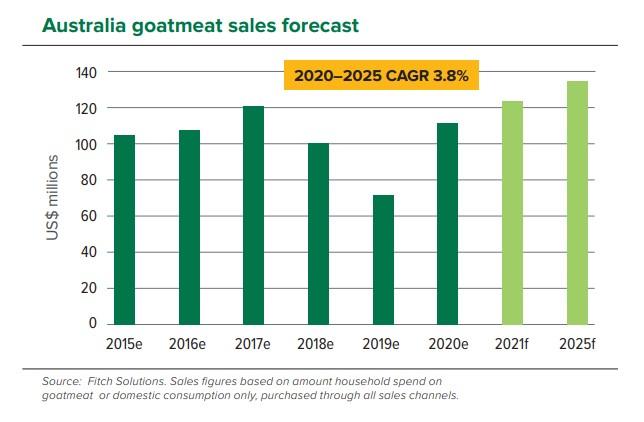

While Australia is a net goatmeat exporter, MLA calculations indicate the domestic market would rank in the top-five largest markets for Australian goatmeat.

It notes, however, that the protein still has a relatively low level of awareness in the general population and limited availability in retail and foodservice restrict the market size, with specific consumer segments driving consumption. Only about 9 per cent of domestic production is consumed in Australia, with the rest exported.

However, MLA has identified several drivers that can be leveraged to grow consumption as production is forecast to grow, including:

- Something special – encourage consumers to make a restaurant-quality goatmeat dish at home by providing them with the information and inspiration.

- New food culture – drive a new trend by leveraging the fact that goat is consumed all over the world, increasing meal-time variety. In particular, increasing the popularity of cuisines that feature goatmeat including Southern Asian, Caribbean, Mexican and Middle Eastern.

- Seasonal suitability – just as summer is the season for seafood and spring is for lamb, winter could be the popular season for goatmeat, as reflected in a number of Asian countries, when slow wet cooking methods are more popular.

- Health credentials – goatmeat is lean and associated with health benefits in some Asian markets.

Find more information on livestock properties for sale and grazing properties for sale on Farmbuy.com