Farmland Prices Record Largest Year-On-Year Increase In 27 Years

Favourable Commodity Prices, Seasonal Conditions And Interest Rates Fuel Price Growth

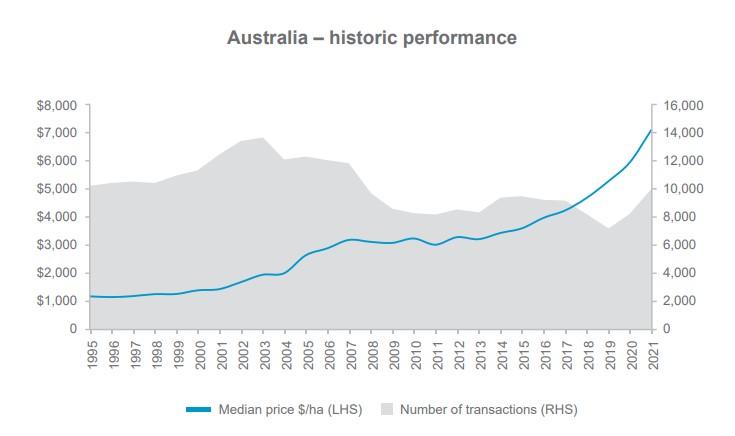

The median price of Australian farmland jumped by 20 per cent in 2021 to $7,087 per hectare – the largest year-on-year increase in dollar terms in the past 27 years and the largest rise in percentage terms since 2005, according to the Australian Farmland Values 2022 report released today.

The national median price has now increased for eight consecutive years, in which time it has risen by 123 per cent, the report produced by Rural Bank found.

It notes that while the recent growth cycle captivates attention, it is important to understand the longer-term perspective of growth in farmland values.

“Strong growth in 2021 lifted the 20-year compound annual growth rate (CAGR) to 8.4 per cent. This is a lower growth rate compared to the last five years which had a CAGR of 12.5 per cent,” the report points out.

“However, the longer-term growth in farmland values has performed incredibly well compared to other asset classes.

“Firstly, growth in farmland values has exceeded residential property prices in Australian capital cities which has a lower growth rate of 5.4 per cent over the last 18 years where data has been published.

“Farmland value growth also outperformed the ASX200 over the last 20 years which has CAGR of four per cent.”

Across The States

The report found Western Australia, Queensland and Victoria all recorded growth of more than 30 per cent in median price per hectare – only the third time since 1995 that more than one state or territory had recorded annual growth of over 30 per cent.

Median price growth was more modest in South Australia, Tasmania and New South Wales, while the Northern Territory recorded a decline.

In addition to strong price growth in 2021, the report found it was a more active market as the number of farmland transactions in Australia increased by 22.5 per cent to 10,032.

“This was the largest annual increase in transaction volume in the past 27 years. In the past two years the number of transactions has increased by 40.3 per cent to fully recover from the drought-induced record low of 2019, taking the number of transactions to its highest level since 2007,” it states.

“Farmland transactions in 2021 equated to a total of 10.8 million hectares of land traded at a record high combined value of $15.6 billion.”

The report draws on more than 270,000 transactions, accounting for 327 million hectares of land traded with a combined value of $183 billion since 1995.

Key Drivers

Broadly speaking, the report notes that demand for farmland is largely the product of a combination of agricultural commodity prices, seasonal conditions and interest rates.

In 2021, each of these factors were conducive to increasing the buying power of Australian farmers and making agricultural land an attractive investment.

“The other factor impacting prices is simply the supply of available farmland on the market. In 2021, the volume of farmland transactions reached a 14-year high. Despite this rise in supply, demand for farmland still exceeded supply,” it points out.

Commodity Prices

Prices for most agricultural commodities continued to trend higher in 2021 which helped strengthen cashflows and balance sheets for many farmers across Australia, improving their buying power and feeding demand for farmland, the report notes.

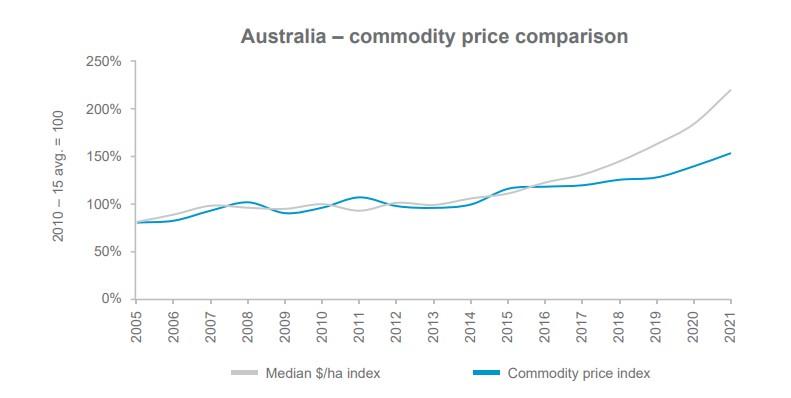

Rural Bank’s Commodity Price Index, which combines indicator prices for major agricultural commodities into a single index by weighting each commodity by its gross value of production, increased by 13.9 per cent year-on-year in 2021 to reach a record high. The growth in the index was driven by increased livestock, canola, wool and cotton prices.

“Despite a strong rise in commodity prices, the median price of farmland increased at an even stronger rate in 2021,” the report notes.

“This resulted in farmland values further decoupling from commodity prices. This decoupling began in 2016 following a period of strong correlation between commodity prices and farmland values.

“Since 2016, the gap between farmland values and commodity price trends has widened. This divergence is evident in all states except for Queensland where a strong correlation continues to exist between the state’s median price per hectare and commodity price index (heavily weighted toward cattle prices).

“The widening divergence between the two trends at a national level in 2021 is likely the result of continued record low interest rates and increased production resulting from a second consecutive year of favourable seasonal conditions.

“These factors enhanced the buying power of Australian farmers, adding to the influence of strong commodity prices.”

Looking to 2022, Rural Bank says the strong commodity price environment is expected to continue with the commodity price index forecast to trend slightly higher as increased cropping prices are expected to add to strong livestock prices.

“However, the increased cost of inputs such as fuel and fertiliser will likely dilute the benefits of high commodity prices and narrow profit expectations, adding an element of caution for prospective buyers in the Australian farmland market,” the bank adds.

Seasonal Conditions

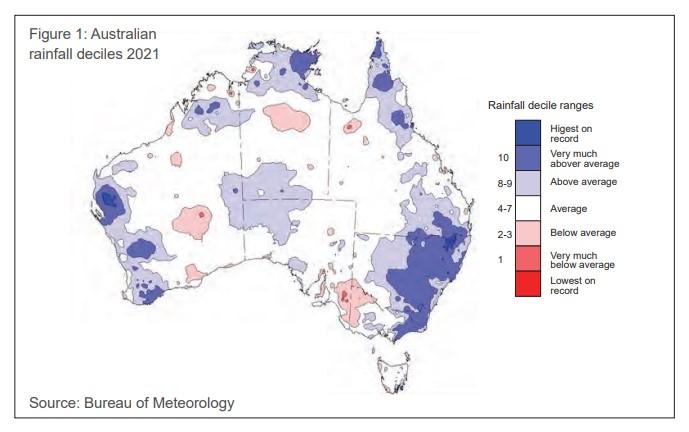

Most agricultural regions in Australia enjoyed favourable seasonal conditions in 2021 which added to drought-breaking rainfall in many areas in 2020 to further strengthen agricultural production, the report notes.

“The combination of high commodity prices and improved seasonal conditions in 2020 meant more producers entered 2021 in a stronger position and with greater intent to purchase land,” it says.

“Confidence to buy would have been boosted further by a second year of above-average rainfall in many areas. Favourable seasonal conditions coupled with higher commodity prices brought more buyers to the property market with greater buying power.”

Seasonal conditions were also a factor in the uplift in transaction volume in the last two years, it adds.

“Dry conditions contributed to declines in farmland transaction volume in 2018 and 2019 as potential sellers held out for improved conditions to market properties. These conditions eventuated in 2020 and 2021 and led to a reversal in the downward trend of transaction volume as more sellers capitalised on improved market conditions to exit the industry,” Rural Bank says.

Many buyers will have entered 2022 in an even stronger position than last year on the back of favourable conditions and higher commodity prices in 2021, the report notes.

“In addition, a wet start to 2022 in many areas will again fuel confidence in the market. This is expected to sustain demand for farmland as the year progresses,” it suggests.

Interest Rates

What’s more, Rural Bank notes interest rates remained at low levels in 2021 with the official cash rate at a record low of 0.1 per cent.

“The ability to borrow money at such low rates added further strength to the buying power of farmers looking to acquire land,” it says.

Rural Bank suggests rising interest rates have the potential to reduce buying power and take some heat out of the market by softening demand.

Supply of Land

The supply of farmland on the market increased in 2021 as strong market conditions improved in favour of those looking for an opportune time to sell, particularly after the preceding drought period.

The report found transaction volume in 2021 was 1.8 per cent above the 20-year average, however it remained below the heights reached in the early 2000s.

“Looking ahead, the volume of farmland transactions is expected to stabilise in 2022. Consecutive years of favourable seasonal conditions and strong commodity prices means there is not much pressure for many landholders to sell and those who delayed listing properties during the drought period have likely realised opportunities to sell in the last two years,” it notes.

“In addition, the longer-term consolidation of farms will contribute to fewer listings. The expectation of a stable supply of farmland on the market in 2022 combined with buy-side factors supporting ongoing strong demand is likely to again drive an increase in prices paid for farmland in 2022.”

To check out more than 3,350 rural properties currently for sale on farmbuy.com click here.