Rural Property Prices Outpace Other Asset Classes In 2022

Rural Property Prices Surge In Every State And Territory In 2022

Rural property prices were incredibly strong in most markets in quarter four of 2022 compared to 2021, highlighting the resilience of rural property as an asset class at a time where other asset classes have struggled, Elders’ latest Rural Property Update reveals.

Released this week, the report analyses the movement of rural property values in the period October 1 to December 31, as well as the calendar year performance comparing 2022 to 2021.

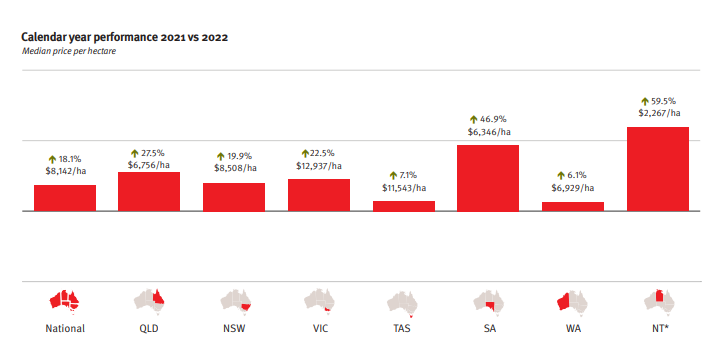

Above: Rural property prices surged to new heights in every state and territory in calendar year 2022

The update, which is written by Elders Market Insights Specialist, Matt Ough, found rural property prices surged to new heights in every state and territory covered by the update.

In contrast, dwelling values in Australia fell 5.3 per cent in 2022, marking the largest calendar year decline in home values since 2008. Meanwhile, the All Ordinaries share market index fell 8.2 per cent for the calendar year.

Above: The market takes cues from the relative performance of agriculture compared to other investment options

Elders General Manager Farmland Agency & Agribusiness Investments, Mark Barber, says the rural property market is now looking for direction in 2023.

“The market will take cues from the relative performance of agriculture compared to other investment options, fundamental support for commodity prices and the impact alternative land uses such as renewable energy, biodiversity offsets and carbon sequestration opportunities,” he says.

Above: The NT and SA recorded the strongest growth in median price per hectare for the 2022 calendar year

Key points for the calendar year 2022:

- National median price per hectare (ha) increased by 18.1 per cent to $8,142/ha, following an 18.2 per cent gain in 2021.

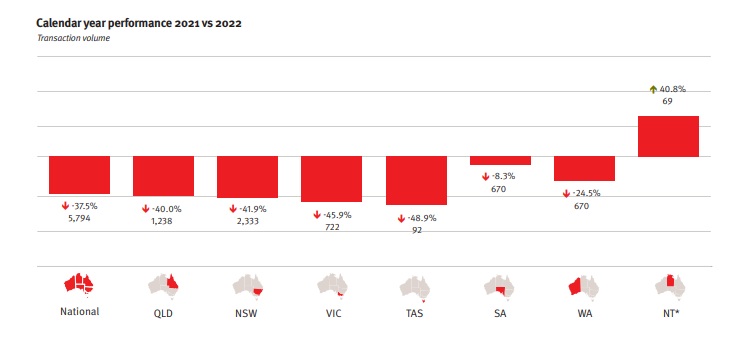

- Transaction volume declined significantly, decreasing by 37.5 per cent in 2022 to 5,794 totalling $11.5 billion.

- The five-year compound average growth rate (CAGR) was 10.5 per cent to the end of 2022, indicating the median price per hectare is doubling every 6.9 years.

Above: The five-year CAGR was 10.5 per cent to the end of 2022, indicating the median price per hectare is doubling every 6.9 years

The NT and SA recorded the strongest growth in median price per hectare for the 2022 calendar year. In the NT prices increased by 59.5 per cent to $2,267/ha driven by an increased volume of high-priced parcels from the Top End region.

Meanwhile, SA recorded growth of 46.9 per cent in 2022 reaching $6,346/ha after two years of flat price growth at state level, the increase was driven by the South East and Yorke regions.

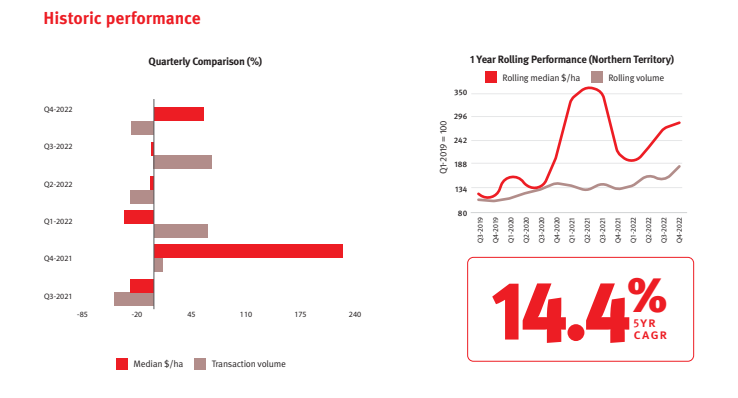

Above: In the NT prices increased by 59.5 per cent to $2,267/ha driven by an increased volume of high-priced parcels

The calendar year results showed a strong increase in prices in New South Wales, up 19.9 per cent to $8,508/ha, the fourth consecutive year of double-digit increases. Top-performing regions included West and North West NSW.

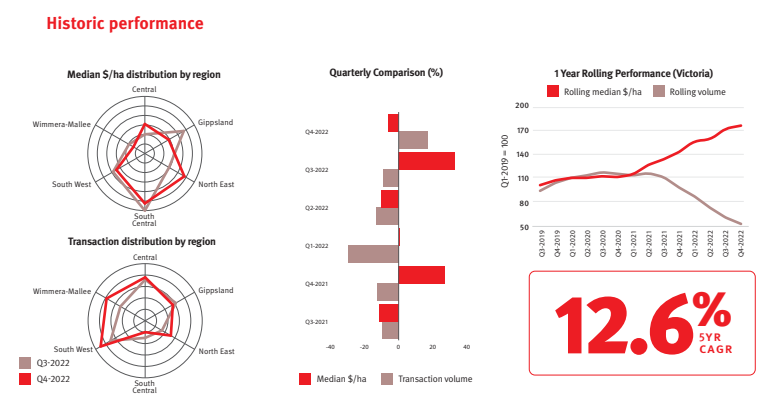

In Victoria, median price per hectare was up by 22.5 per cent to $12,937/ha, the second consecutive year of growth above 20 per cent.

Above: Transaction volume in most states came off a high set in 2021 after a flurry of sales driven by drought relieving rains

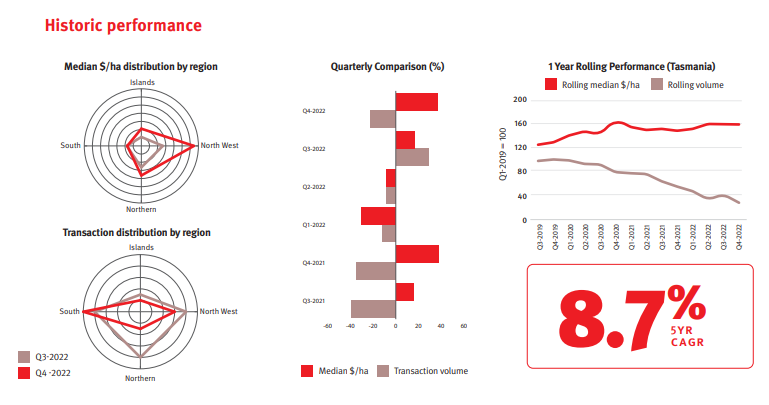

The significant decline in transaction volume for the calendar year was most pronounced in Tasmania with a drop of 48.9 per cent followed by Victoria down by 45.9 per cent.

Transaction volume in most states came off a high set in 2021 after a flurry of sales driven by drought relieving rains. Nationally, median price per hectare increased by 11.2 per cent in Q4 2022, taking the quarterly median price to $9,019/ha. Transaction volume declined by 1.7 per cent, totalling 1,334 in the fourth quarter.

Above: At state level, the NT and Tasmania recorded the highest growth in median price per hectare in Q4 2022

At state level, the NT and Tasmania recorded the highest growth in median price per hectare in Q4 2022, up 59.6 per cent and 36.5 per cent respectively, primarily driven by a shift in transaction mix favouring high priced parcels in the Top End region of the NT and the Northern region of Tasmania.

Elders recognises that the landscape for rural property has changed in 2023 with many buyside factors softening and others emerging as potential drivers of growth.

Above: Land holders are reluctant to sell out of agriculture unless they see viable investment options in other asset classes

“Whilst there is some volatility creeping into agricultural operating conditions, it is likely that the relative performance of rural land as an asset class compared to other investment options is playing a strong role in investment decisions,” Barber says.

“That is, land holders are reluctant to sell out of agriculture unless they see viable investment options in other asset classes. Similar sentiment is held by buyers. Ongoing volatility in financial markets is likely to be supportive of farmland values.

Above: In Victoria, median price per hectare was up by 22.5 per cent to $12,937/ha, the second consecutive year of growth above 20 per cent

“Cost pressures continue to erode margins, but there is limited evidence of a sustained change in demand for food and fibre. The FAO food price index has fallen during 2022 but remains well above historical levels, second only to the peak in real terms in the mid-1970s.

“As reported in previous editions, there is a strong correlation between commodity prices and farmland values.”

Above: Elders is seeing rising demand for farmland that can provide carbon sequestration and biodiversity credits

Barber adds that Elders is seeing rising demand for farmland that can provide carbon sequestration and biodiversity credits. “The farmland based carbon and environmental ‘services’ market will continue to evolve in 2023 and is likely to have an increasing impact on farmland values”, he says.

Elders source transactional level data for every rural property sale above 40 hectares in Australia from Corelogic before undertaking in-depth analysis to remove non-agricultural land uses and statistical outliers.

To download Elders Rural Property Update in full and to subscribe to future updates visit, visit here.